Health care-associated infections (HAIs) are a serious and often overlooked problem, affecting millions of people around the world. As a growing issue, understanding the causes, risks and preventive measures of HAIs is important to protect yourself and your loved ones from these dangerous infections. In this article, we will cover the basics of HAIs, from the different types of infections to the prevention methods that can help keep you safe. With a better understanding of HAIs, you can be empowered to make informed decisions about your health care and the safety of your loved ones.

Understanding Health Care Associated Infections

Health care associated infections (HAIs) are infections caused by bacteria, viruses, fungi, or parasites that are acquired from a health care setting. These infections can occur in hospitals, nursing homes, doctor’s offices, and other medical facilities, and can be spread through contact with medical staff, equipment, or other patients. HAIs are a serious public health concern, as they can lead to longer hospital stays, higher medical costs, and even death. To reduce the risk of infections, it’s important to be aware of the common types of HAIs and how to prevent them. Good hygiene practices like handwashing and proper sterilization of medical equipment are key in helping to keep infections at bay. Additionally, keeping up-to-date on vaccinations and avoiding contact with people who have infectious diseases can help protect against HAIs. By following these simple steps, we can help keep ourselves and others safe from the dangers of health care associated infections.

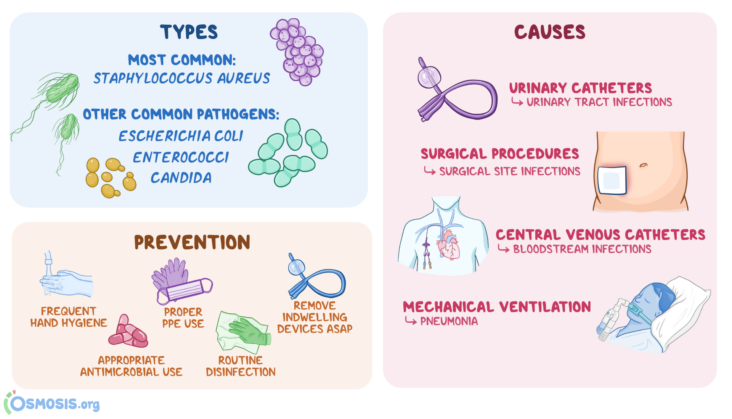

The Different Types of Health Care Associated Infections

Health Care Associated Infections (HCAI) can be a major problem in any health care setting, but luckily there are a few different types that can be identified and treated. The most common types of HCAI are bacterial, viral, and fungal infections; though there are also protozoal, prion, and helminthic infections that can occur. Bacterial infections are caused by germs like E. Coli, Salmonella, and Staphylococcus, while a viral infection is caused by a virus like influenza, hepatitis, or HIV. Fungal infections like aspergillosis, candidiasis, and coccidioidomycosis are also a type of HCAI, and can be more difficult to treat than bacterial or viral infections. Protozoan infections like malaria, cryptosporidiosis, and giardiasis, prion infections like Creutzfeldt-Jakob disease, and helminthic infections like roundworms, tapeworms, and hookworms can also be health care associated infections. Identifying and treating HCAI can be a difficult task, but it’s important to do so to ensure the safety of patients.

The Risks of Health Care Associated Infections

it.Health care associated infections (HAIs) are a real threat to anyone who has to go to the hospital or use medical services. The risks of HAIs range from mild to severe, and can lead to an extended hospital stay, long-term health problems and even death. It is incredibly important to be aware of the risks of HAIs before undergoing medical treatment, and to take precautions to protect yourself. Common HAIs include urinary tract infections, surgical site infections, bloodstream infections, and pneumonia. They can be contracted from contact with contaminated surfaces, equipment, and even healthcare workers, so it is important to be aware of your surroundings and take steps to protect yourself. Simple steps like washing your hands often, and making sure to keep up with your vaccinations can help reduce the risk of HAIs.

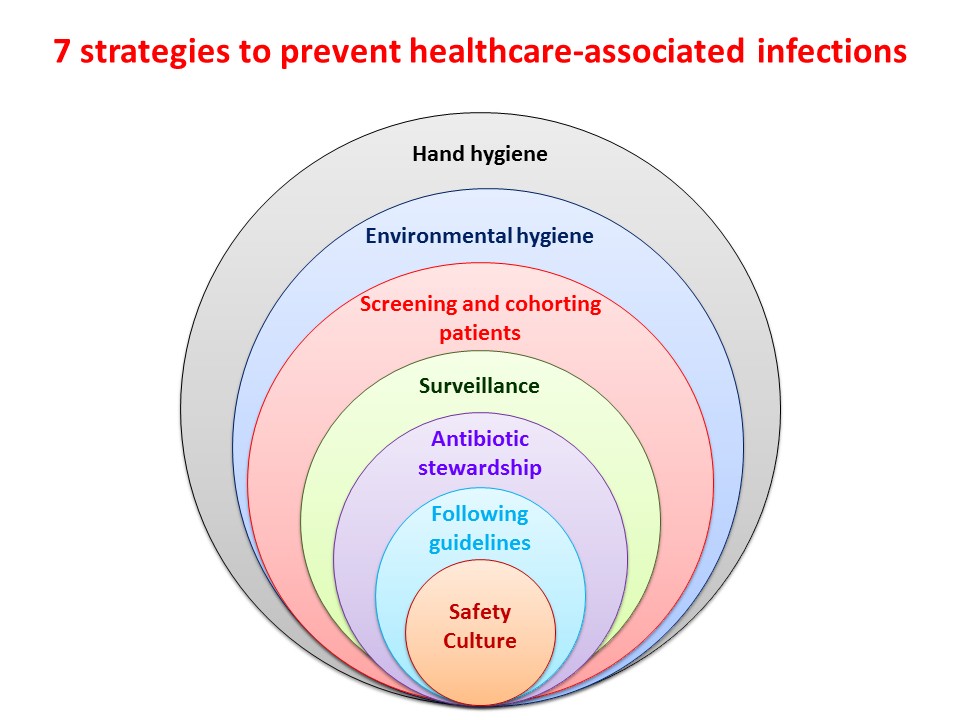

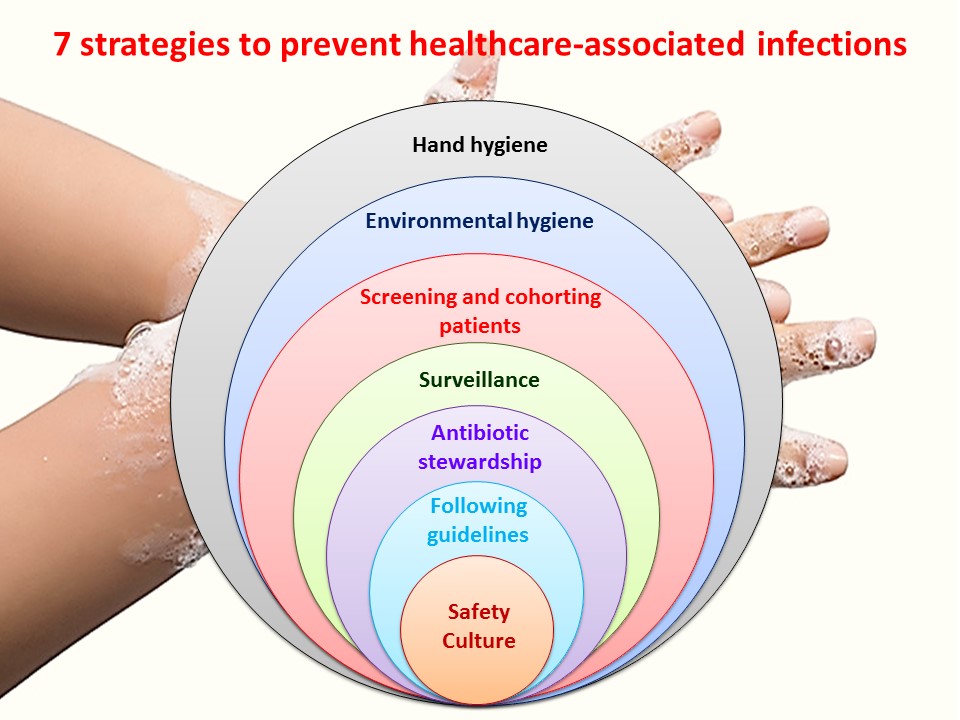

Prevention Strategies to Avoid Health Care Associated Infections

If you’re looking to avoid health care associated infections, there are some key prevention strategies that you should be aware of. First, always make sure you are up-to-date on your vaccinations. This is especially important if you are going to the hospital or doctor’s office. Second, practice good hygiene and make sure to wash your hands before and after visiting any medical facility. Third, always keep your medical equipment clean and sanitized. Fourth, if you are using any antibiotics, make sure to follow the prescription instructions carefully. Finally, be sure to speak up if you feel like something isn’t right. Don’t be afraid to ask questions and voice any concerns you may have. These strategies are essential for avoiding health care associated infections and keeping yourself and your family safe.

Properly Treating Health Care Associated Infections

Properly treating health care associated infections is key to not only reduce the spread of infection, but also to ensure the patient receives the best possible care. One of the most important things to remember is to practice proper hygiene. This includes washing hands regularly, wearing gloves and masks when appropriate, and using disinfectants that are approved by the CDC. Additionally, proper cleaning and disinfecting of medical equipment is essential to prevent the spread of infections. It is also important to educate patients on the importance of proper hygiene and to follow the doctor’s instructions. By following these steps, health care professionals can help keep patients safe and reduce the risk of health care associated infections.