Having a strong and toned core is a great way to feel confident and improve your overall health. If you’re looking for the best workouts to get a fit core, you’re in the right place! In this article, we’ll discuss the top exercises for a strong and toned core. We’ll also give you tips on how to maximize your results, so you can get the most out of your workouts. With these exercises and tips, you’ll be able to build your core strength and get a toned stomach in no time. So, if you want to get a strong core, get ready to learn the best workouts for a toned midsection.

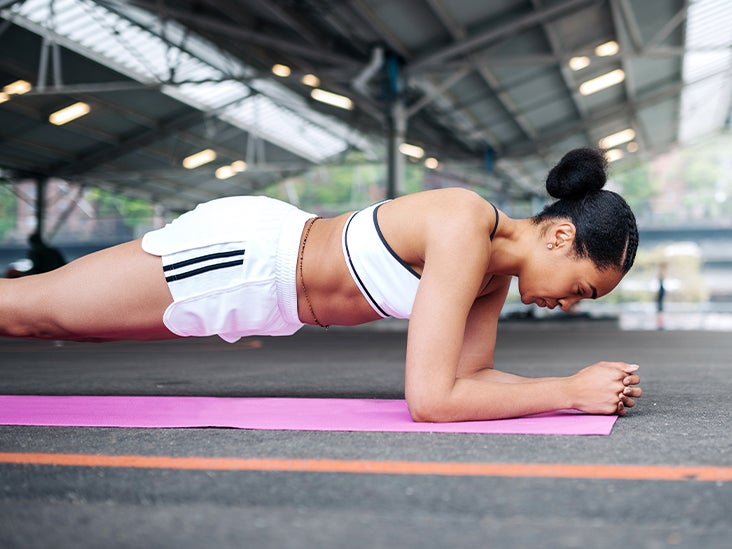

Plank: Plank is an effective way to strengthen your core muscles, including your abdominal muscles, back muscles and the muscles around your pelvis

Planking is the ultimate core workout! It’s a great way to get strong and toned abs and back muscles in no time. Plus, it’s super easy to do. All you need is a flat surface and your own bodyweight. To do a plank, start in a push-up position with your arms straight and your feet together. Then, lower your forearms to the ground and hold this position for 30-60 seconds. Make sure to keep your back flat and your core engaged. With regular practice, you’ll soon be feeling the burn in your abs, obliques, and lower back. Planking is an effective way to make sure your core is strong and toned. So, what are you waiting for? Get planking today!

It also helps to improve posture and balance.

Having a strong and toned core is great for more than just looking good. It also helps to improve posture and balance, which is essential for a variety of activities. A strong core can help you move more freely and efficiently, as well as helping you perform everyday tasks with greater ease and less fatigue. Working out your core also helps to reduce low back pain, improve your balance and agility, and improve your overall physical performance. There are plenty of exercises and workouts that you can do to strengthen your core and give you a toned, sculpted midsection. These exercises range from planks, sit-ups, crunches, mountain climbers, and more. So if you’re looking to get a strong, toned core, start incorporating core exercises into your workout routine today.

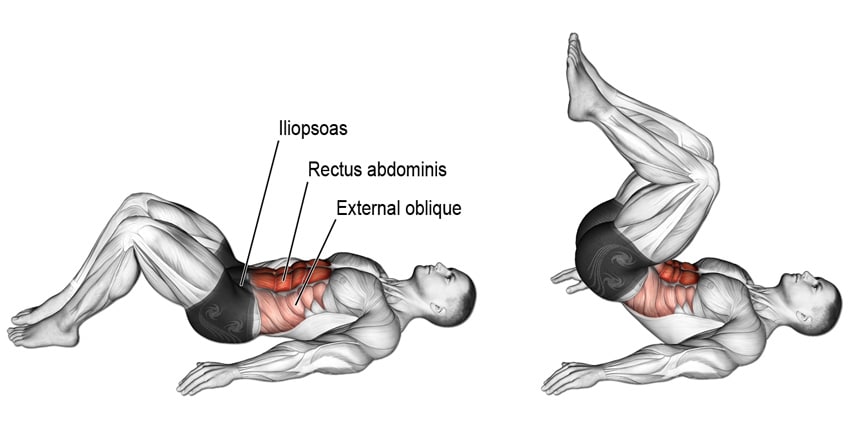

Dead bug: This exercise is great for targeting your lower abdominal muscles and strengthening your core

If you’re looking for an awesome core workout, dead bug is definitely the way to go! This exercise is super effective when it comes to toning and strengthening your lower abdominal muscles. Plus, it’s easy to do and you don’t need any equipment. All you need to do is lie on your back, with your arms and legs extended. Then, alternate between extending your opposite arm and leg away from your body while keeping your core tight. Doing this exercise regularly will help you get those strong and toned abs in no time. Plus, you’ll be able to show off your newly-defined core at the beach this summer!

It also helps to improve your coordination and balance.

Having a strong and toned core is important for so many reasons. Not only does it help with posture and overall appearance, but it can also help improve your coordination and balance. Having a strong core means that your body is better able to control its movements and maintain balance in any given situation. This can be especially beneficial for activities like sports and physical fitness. Working out your core can also help protect your spine by providing it with support and stability. It’s also important for improving your overall performance, as having a strong core can help you generate more power and speed in your movements. By adding core-strengthening exercises to your regular workout routine, you can help improve your coordination and balance while also working towards a strong and toned core.

Russian twist: This is a challenging exercise that will help to strengthen your core, as well as your shoulder and hip muscles

.Russian twists are one of the best core workouts out there to help you achieve a strong and toned midsection. This exercise is great for your upper body as well, as it works your shoulder and hip muscles. To do the Russian twist, start by sitting on the floor with your legs bent and your feet flat on the ground. Put your hands together in front of your chest, keeping your palms together. Now twist your torso to the left and then to the right. Make sure you keep your back straight throughout the exercise and keep your core tight. This exercise is great for developing balance and stability in your core, as well as strengthening it. Try to do 3 sets of 10-15 repetitions for the best results. Russian twists are a great way to work your core and get the strong and toned midsection you desire.

It can also help improve your posture and balance.

Having a strong and toned core is essential for more than just looking great in a swimsuit. A strong core can help you have better posture, balance, and even overall strength. Keeping your core in shape can help you move better and feel better. Working out your core regularly can help you improve your posture and balance, as well as give you an overall stronger body. With the right core exercises, you can enjoy all the benefits of a strong and toned core. From planks to crunches to Russian twists, there are plenty of core workouts to choose from that can help you reap the rewards of a strong and toned core. So, ditch the old sit-ups and try out some of these awesome core exercises to get the body you desire.

Mountain climbers: This exercise is great for targeting your abdominal muscles and improving your coordination and balance.

Mountain climbers are one of the best exercises for building a strong and toned core. Not only are they great for targeting your abdominal muscles, but they also help improve coordination and balance, making them a great full-body workout. Plus, they’re easy to do just about anywhere. All you need is a little bit of space and you can get to work! Start off in a high plank position, and then alternate bringing your knees up towards your chest as if you were running in place. Make sure to keep your back flat and your core engaged throughout the entire movement. With consistent practice and dedication, you’ll be rocking a strong, toned core in no time!

Reverse crunch: This exercise is great for targeting

Reverse crunch is the perfect exercise to help you get that strong and toned core you’ve always wanted. This exercise directly targets your lower abdominal muscles to strengthen and tone them. To do a reverse crunch, lie flat on your back with your feet on the floor and your knees bent. Then, raise your hips off the floor while at the same time, press your lower back into the ground. Keep your feet and knees together as you lower your feet back to the floor and repeat. Doing this exercise will not only help you target those lower abdominal muscles, but it will also help you strengthen your overall core. Add reverse crunches to your routine and you’ll be sure to see a difference in your core strength and tone!