Health insurance can be a confusing and overwhelming topic for many Americans. Understanding how health insurance works in the US can help you make sense of your coverage and maximize your benefits. In this article, we’ll delve into the basics of health insurance, from the different types of plans available to how to enroll and use your coverage. We’ll also discuss the importance of understanding your insurance plan and the potential risks of being uninsured. Get ready to become a health insurance expert!

Understanding Health Insurance Coverage in the US

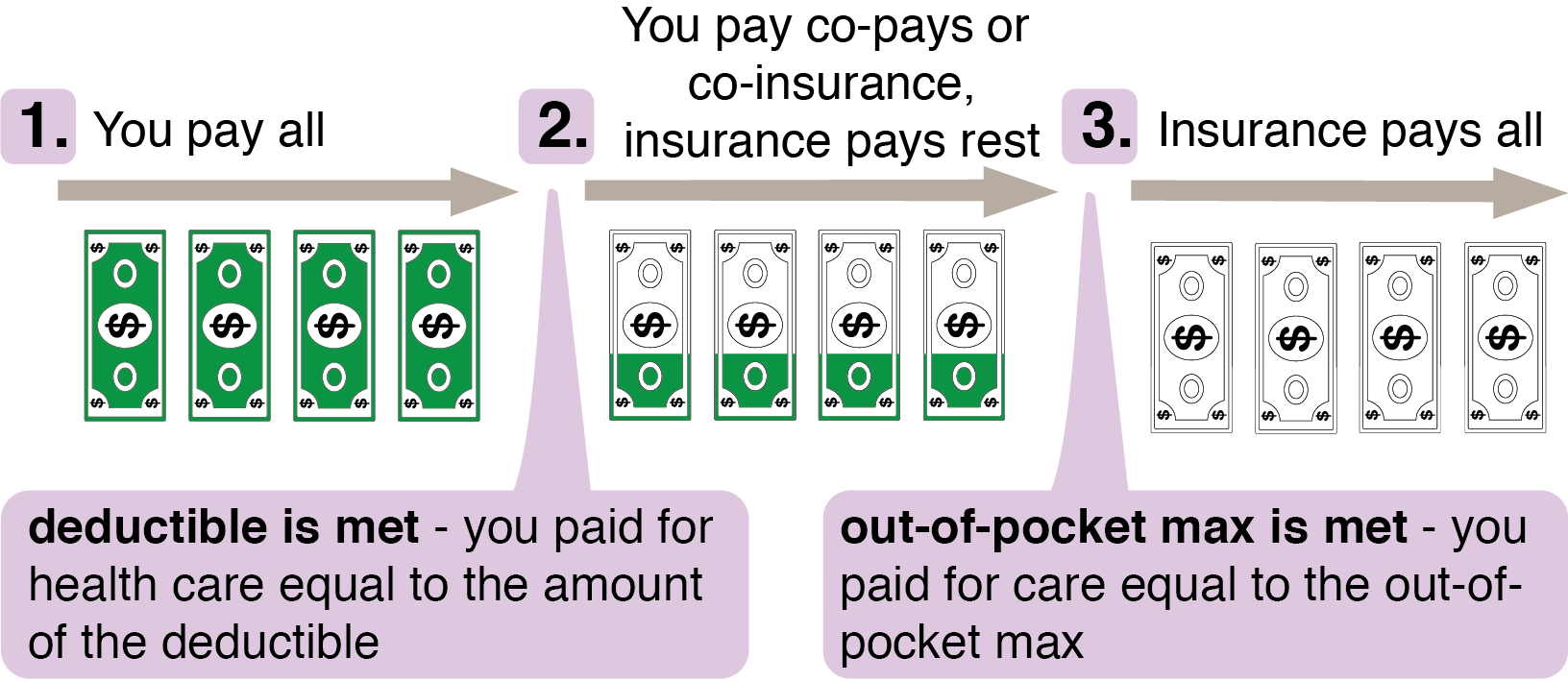

Understanding health insurance coverage in the US can be overwhelming and a bit confusing. It’s important to understand how it works and how to get the best value when selecting a health plan. Health insurance in the US is divided into three main parts: premiums, deductibles, and copays. Premiums are the amount you pay each month for your health plan, deductibles are the amount you pay out of pocket before your health plan begins to pay, and copays are the set amount you pay for certain services. Knowing how these three parts work together will help you understand how to get the most out of your health insurance coverage in the US. Knowing what kind of coverage you need and how much you are willing to pay for it can help you make the best decisions for your health and wallet. Don’t forget to compare plans and read through the fine print to make sure you’re getting the best coverage for your needs.

Types of Health Insurance in the US

When it comes to health insurance in the US, there are plenty of options to choose from. PPOs, HMOs, EPOs, and HSAs are just a few of the types of health insurance plans that are available. PPOs are known for their flexibility, allowing you to see any doctor you want without the need for a referral. HMOs are more cost-effective and offer a network of doctors and hospitals for you to choose from. EPOs are similar to HMOs but don’t require referrals and also offer access to a network of doctors. HSAs are tax-advantaged accounts that allow you to pay for qualified medical expenses with pre-tax dollars. No matter what type of health insurance you choose, it’s important to do your research and compare plans to make sure you’re getting the best coverage for your needs.

Benefits of Having Health Insurance

Having health insurance is a great way to make sure you’re taking care of your health. Not only does it provide financial protection in case of an emergency, but it can also help you access preventive care. With health insurance, you’ll be able to visit the doctor for regular checkups, get the recommended vaccinations, and get the prescription drugs you need. Plus, if you have an accident or become ill, having health insurance can help you manage the medical costs that come along with it. It’s a great way to take charge of your health and make sure you get the care you need.

How to Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be daunting, so it’s important to do your research to make sure you’re getting the coverage you need at the best value. Start by considering the basics: what services and treatments you’ll need, which doctors you want to use, and what your budget is. Additionally, you’ll want to look at the plan’s co-pays and deductibles, as well as any additional fees or restrictions. Finally, think about the future and make sure the plan you select will be able to accommodate any changes in your health or lifestyle. With the right knowledge and research, you can find the perfect health insurance plan for your individual needs.

What to Do if You Can’t Afford Health Insurance

If you can’t afford health insurance, don’t worry – there are still options available to you. You may qualify for an exemption from the Affordable Care Act (ACA) if your income is low enough, or if you’re facing certain hardships that prevent you from affording health insurance. Additionally, you may be eligible for government-sponsored programs such as Medicaid or the Children’s Health Insurance Program (CHIP), which provide affordable coverage for those in need. Even if you don’t qualify for an exemption or a government-sponsored plan, there are still other options available, such as short-term health insurance plans, which provide coverage for a limited period of time, or discounted health insurance plans that provide coverage at a reduced cost. No matter your financial situation, it’s important to explore all of your options to find the best plan that fits your needs.