Are you confused about health insurance deductibles? Don’t worry, you’re not alone. Many people have questions about what a deductible is and how it works. In this article, we’ll explain exactly what a health insurance deductible is, how it works, and how it can affect your medical expenses. We’ll also provide tips on how to save money on your health care costs. Get ready to learn everything you need to know about health insurance deductibles and how to make the most of them.

What is a Health Insurance Deductible?

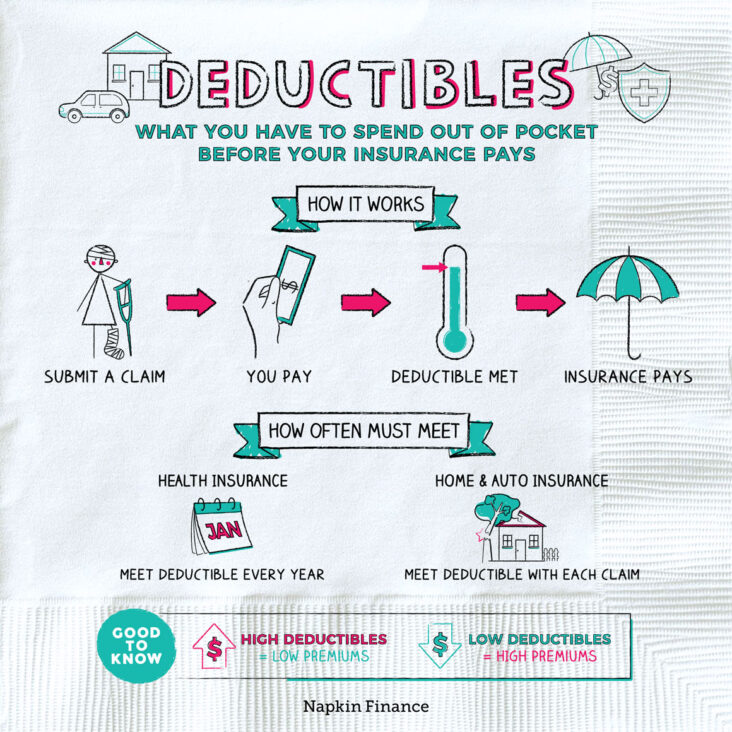

When it comes to having health insurance, understanding deductibles is key. A health insurance deductible is a set amount you have to pay before your insurance provider will start covering any medical expenses. So, if you have a $2,000 deductible, you’d have to pay for any medical expenses up to $2,000 before your insurance kicks in. Depending on your plan, the deductible can apply to all services or just certain services. It’s important to read your policy and know what your deductible covers. It’s also important to know that your deductible resets each year, so you’ll have to pay up to the deductible amount every year. Deductibles can be a challenge to navigate, but understanding them is essential for making sure you get the most out of your health insurance.

How Health Insurance Deductibles Impact Your Costs

When it comes to health insurance deductibles, it’s important to understand how they can impact your costs. A health insurance deductible is the amount of money you have to pay out of pocket before your health insurance kicks in. The higher your deductible is, the lower your premiums will be, but it also means you have to pay more upfront before you can use your insurance coverage. Knowing your deductible and how it works can help you plan for medical expenses, and make sure you’re staying within your budget. When you know what you’ll have to pay out-of-pocket, it’s easier to make decisions about your healthcare needs.

What are Common Deductible Amounts?

When it comes to health insurance deductibles, there are a few common amounts that you’ll come across. The most common deductible is $1,000 per year, but some plans may offer deductibles as low as $500 or as high as $10,000 or even higher. If you’re looking for a plan with a lower deductible, you may want to check out a High Deductible Health Plan (HDHP). These plans usually come with a higher deductible, but also offer lower premiums. Many HDHPs will also qualify you for a Health Savings Account (HSA), which can help you save for future medical expenses. So if you’re trying to balance the cost of your health insurance premiums with the amount of your deductible, an HDHP may be a great option for you.

How to Minimize Your Health Insurance Deductible

If you’re looking for ways to minimize your health insurance deductible, there are a few things you can do that can help. First, it’s important to shop around for the best rate. Compare plans from different providers and get quotes to make sure you’re getting the best deal. Also, consider raising your deductible. Increasing your deductible will lower your monthly premium, and if you don’t expect to need a lot of medical attention, it’s a good way to save some money. Another option is to look for a health savings account. This is a great way to save for medical expenses, and if you contribute regularly, you’ll have money available to help pay for your deductible if needed. Finally, make sure you take advantage of preventative care. If you get regular check-ups, you’re less likely to need expensive medical interventions in the future, which can help keep your costs down.

When to Consider Increasing Your Health Insurance Deductible

If you’re trying to save some money on your health insurance premiums, it may be worth considering increasing your deductible. Increasing your deductible can lower your overall costs, though it also means that you’ll have to pay more out of pocket for health care before your insurance kicks in. This is a great option for those who don’t plan to use their insurance often, as it can help keep your premiums low. Before making this decision, make sure that you understand all of the potential risks and rewards associated with it, and consider the impact it could have on your budget. If you decide that increasing your deductible is the right move for you, you can start saving money right away.