Myths about fitness abound, but which ones are actually true? Are there any that have been debunked? In this article, we will be exploring the top 10 fitness myths that have been debunked and showing you the truth behind them. We will also provide evidence and research to back up our claims so you can make the most informed decision about your own fitness journey. So, if you’re looking for some debunking and clarification, keep reading to learn the truth about the top 10 fitness myths!

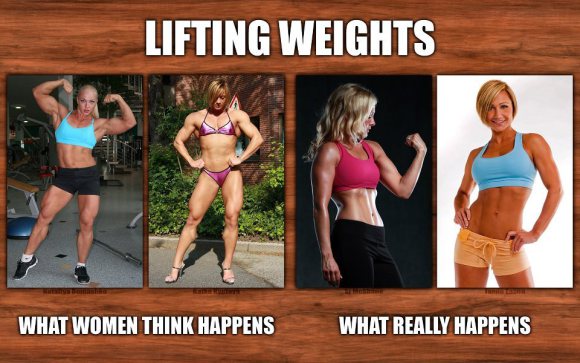

Lifting weights will make women bulky – False

This is a myth that we hear all the time, and it’s simply not true! Women are naturally not built to be bulky, and lifting weights will not make them bulky. The truth is that lifting weights can help women with overall body toning, and it can help them to build lean and strong muscles. It can also help them to increase their metabolism and burn fat more efficiently. So if you’re a woman looking to get fit, don’t be afraid to lift weights! You can still achieve your fitness goals without the worry of bulking up.

Women do not have the necessary hormones to gain large amounts of muscle.

There’s a common misconception out there that women don’t have the hormones to gain large amounts of muscle. This isn’t true – the truth is that everyone has the hormones to gain muscle, regardless of their gender! Women’s bodies just respond differently to the same exercise and nutrition habits, meaning that they may gain muscle in different areas or at a different rate than men. So, if you’re a female looking to bulk up, don’t let anyone tell you that you don’t have the hormones to do it! With a healthy diet and regular exercise, you can gain the muscle you desire, just like anyone else. Don’t let anyone hold you back from achieving your fitness goals!

You can spot reduce fat – False

Spot reduction of fat is one of the most talked-about myths when it comes to fitness. Sadly, it’s also one of the biggest lies. You can’t target specific areas of your body and expect to lose fat in that area. It simply doesn’t work that way. Fat loss is a full-body process. You can’t just expect to lose fat in your stomach, thighs, or arms by working out those areas. To lose fat, you need to burn more calories than you consume and exercise regularly. To get the best results, you should focus on working out your entire body and eating a healthy, balanced diet. It’s the only way to achieve the results that you want. So don’t waste your time trying to spot reduce fat. Instead, focus on creating an overall healthy lifestyle for yourself and you’ll be much more likely to see the results you want.

Spot reduction is not possible as fat loss occurs over the entire body rather than in one specific area.

Spot reduction is a myth that many people believe in, but unfortunately it’s not true. Fat loss cannot be targeted to a specific area of the body. Instead, when you lose fat, it happens all over your body. This means that if you want to lose fat in a certain area, you will have to lose it everywhere. The best way to do this is through a combination of diet and exercise. Eating a healthy diet and doing regular workouts that target your entire body will help you to lose fat and reach your fitness goals. Don’t be fooled into thinking spot reduction is possible, it’s not!

Crunches are the best way to get abs – False

Crunches are often seen as the holy grail of ab exercises, but the truth is that they’re not the best way to get abs. Crunches are limited in the ways that they work your core, focusing mainly on the rectus abdominis (the six-pack muscle). Working only this muscle won’t give you the toned and sculpted abs you’re looking for, so it’s important to focus on exercises that target the entire core. Plank variations, side planks, leg raises, and other exercises that involve the obliques and transverse abdominis are much better for sculpting your abs. Doing a variety of exercises will also help you to avoid overworking one muscle and leading to injury. Bottom line – don’t rely on crunches alone to get the abs you want. Incorporate a variety of ab exercises into your routine to get the toned and sculpted look you’re after.

Crunches alone will not give you a toned and defined stomach

Crunches are a common exercise that many people do in order to get a toned and defined stomach, but unfortunately, crunches alone won’t do the trick. Crunches are great for strengthening your core muscles, but if you really want to get that toned and defined stomach, you’ll need to do more than just crunches. To get results, you’ll need to combine your crunches with other exercises that target the stomach area, such as planks and leg raises. You should also focus on reducing your overall body fat through a combination of cardio and a healthy diet. With the right combination of exercises and diet, you can finally get the toned and defined stomach you’ve always wanted.

You need to engage in full body workouts to achieve a toned midsection.

Working out your midsection can be daunting, especially if you’re not sure where to start. You may have heard that you need to do full body workouts in order to get a toned midsection, but is this true? The answer is yes and no. While full body workouts can help you tone and strengthen your midsection, you don’t necessarily have to do them to get the results you’re looking for. You can focus on specific exercises that isolate your core muscles and still achieve the toned midsection you desire. Core exercises like planks, sit-ups, and wall sits can help you strengthen and tone your midsection without having to engage in full body workouts. There are also other ways to work on toning your midsection such as cardio, yoga, and Pilates. All of these exercises can help you achieve the toned midsection you want without necessarily having to do full body workouts.

High-intensity interval training (HIIT) is the only way to get in shape – False

High-intensity interval training (HIIT) is often touted as the best way to get in shape. But there are plenty of other effective training methods that can help you get into great shape. If you don’t have the time to commit to HIIT, there are still plenty of other workouts that can help you achieve your goals. Resistance training, yoga, Pilates and other forms of exercise can help you tone your body and increase your overall fitness level. Don’t be fooled into believing that HIIT is the only way to get in shape. There are plenty of other exercises that can help you reach your fitness goals.

HIIT is a great way to improve fitness levels, but there are many other effective methods

HIIT can be an awesome way to take your fitness to the next level, but it’s not the only way to get fit. There are plenty of different options to choose from when it comes to improving your fitness, including strength training, running, walking, cycling, and even yoga. Each one of these methods has its own benefits and can help you reach your fitness goals. Strength training and running can help build muscle and increase your metabolism, while walking and cycling can help you lose weight and get in shape. Yoga can help with flexibility, balance, and focus. Whichever way you decide to go to get fit, you can be sure that it will be a journey worth taking. So don’t limit yourself to just HIIT – explore all the different options out there and find the one that works best for you!