Health insurance is an integral part of our lives, but unfortunately, it can be costly. While it may seem like your health insurance premium increases every year, there are a variety of factors contributing to the rise in costs. In this article, we’ll explore the different reasons why health insurance premiums are increasing and what you can do to protect yourself from the financial burden. From changes in the healthcare industry to the impact of COVID-19, we’ll cover it all and help you find ways to manage the rising costs.

What Causes Health Insurance Premiums to Increase

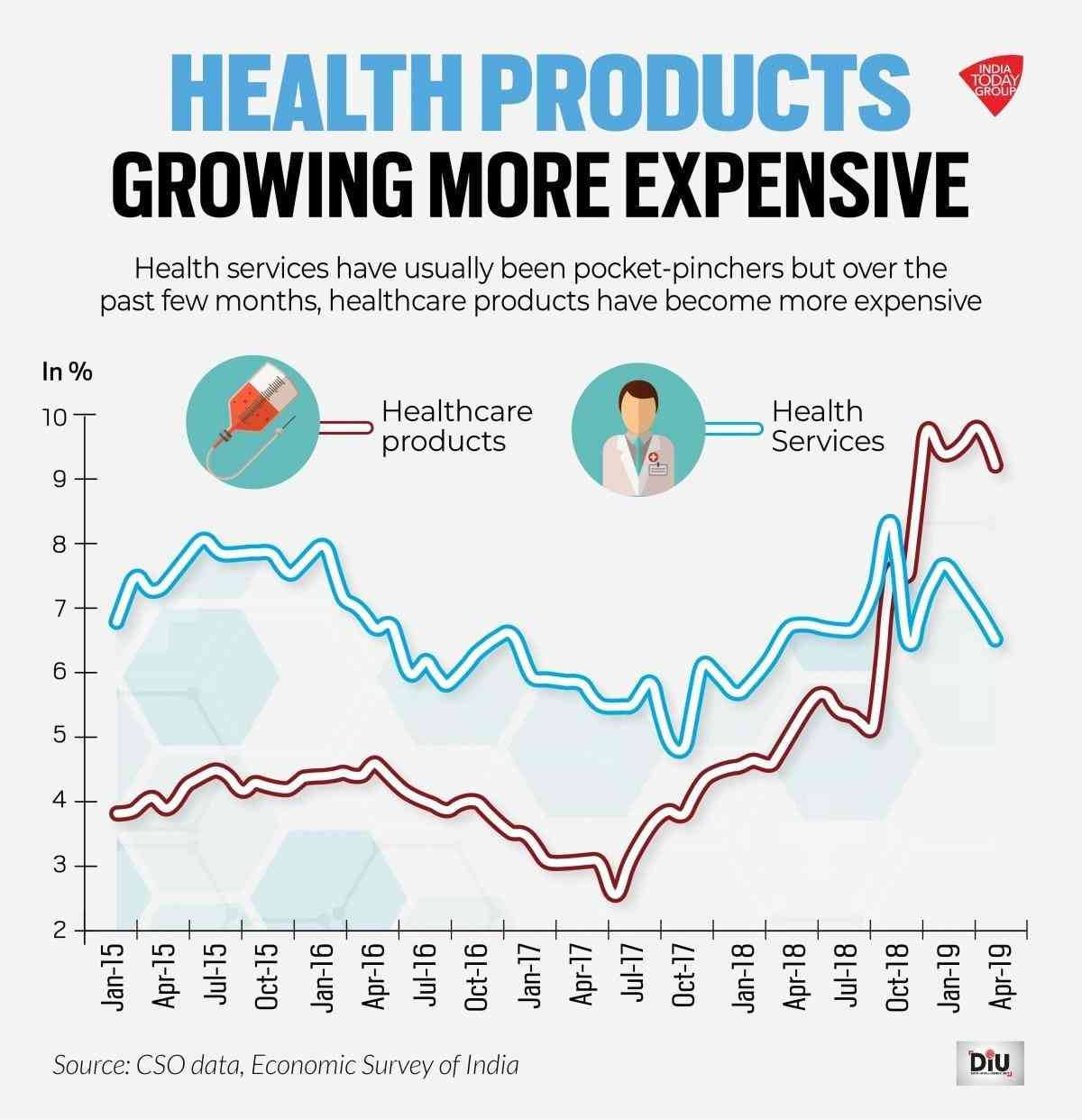

Health insurance premiums are on the rise and it’s causing a lot of stress for people trying to figure out how to pay for their coverage. There are a few key factors that contribute to the increasing cost of health insurance premiums, including rising medical costs, increases in prescription drug prices, and changes in the law. Medical costs have been on the rise due to increased demand and rising costs of medical care, such as hospitalization and doctor visits. Furthermore, prescription drug prices have been increasing as drug makers try to maximize profits. Lastly, changes in the law, such as the Affordable Care Act, have led to more people being covered by health insurance, which has also caused premiums to rise. Figuring out how to manage these rising costs can be a challenge, but understanding the factors that cause health insurance premiums to increase is a good first step.

Understanding the Factors Behind Rising Premiums

As a 20 year old, the rising cost of health insurance premiums is something that I am all too aware of. I know that understanding the factors behind them is the only way to prepare for what’s to come. From rising medical costs to the increase of the uninsured, there are a lot of reasons that insurance premiums are on the rise. Medical costs are always increasing, and without the help of insurance, these costs can be too much for people to pay. The increase of the uninsured is also a factor, as people who don’t have health insurance often rely on the healthcare system to cover their medical bills. This increases premiums for everyone, as insurance companies have to cover the cost of these medical bills. Overall, the rising cost of health insurance premiums is something to be aware of, and understanding the factors behind them is the best way to prepare for what’s to come.

How to Reduce Your Health Insurance Premiums

If you’re looking for ways to reduce your health insurance premiums, there are a few simple steps you can take. First, shop around for the best rates. Comparing costs from different insurance providers is one of the best ways to ensure you get the lowest premiums possible. Additionally, look for plans with a higher deductible. While this might mean you’ll have to pay more out-of-pocket if you need to use your insurance, it can help you save money in the long run. Finally, make sure you take advantage of any discounts or incentives your insurance provider may offer. By following these tips, you can lower your health insurance premiums and save yourself some money.

The Role of Government Regulation in Increasing Premiums

Government regulations play a major role in increasing health insurance premiums. One of the biggest factors is the Affordable Care Act, commonly known as Obamacare. This law requires insurers to provide coverage for pre-existing conditions, which drives up the costs of premiums. Additionally, the law also requires that insurers provide certain essential health benefits, meaning that companies have to cover a wide range of services, which can all add up and increase premiums. Lastly, the law also forces insurers to limit the amount of cost-sharing they can impose on individuals, which can also lead to higher premium costs. All of these regulations put together can lead to a significant increase in health insurance premiums.

Impact of Health Insurance Premiums on Consumers

The rising cost of health insurance premiums is having a major impact on consumers. With premiums rising every year, many people are struggling to afford quality coverage. This means that consumers are having to make tough decisions about their health care. They may have to forgo regular doctor visits, or opt for cheaper, yet less comprehensive health insurance plans. In addition, some consumers may even choose to go without health insurance altogether, leaving them vulnerable to high medical costs. In this situation, the consumer is faced with a difficult choice of either sacrificing their health or their finances. It’s a difficult decision, and it’s one that can have serious, long-term implications.