If you’re wondering when you can start claiming health insurance benefits, you’ve come to the right place! With so many different rules and regulations to consider, it can be hard to know when you can start taking advantage of your health insurance coverage. In this article, we’ll provide you with a comprehensive overview of the key points to consider when trying to determine when health insurance can be claimed. We’ll also address some common misconceptions about health insurance and discuss how to make the most of your coverage. So keep reading to learn when you can start making the most of your health insurance!

What to Know About Health Insurance

When it comes to health insurance, it’s important to understand what you’re getting into before signing up. Knowing when you can claim health insurance and what it covers can save you a lot of time and money in the long run. Knowing what to expect and what your coverage includes is key to getting the most out of your health insurance. Knowing when you can claim health insurance is essential to ensuring you get the best coverage for your needs. Depending on your plan, you may be able to make claims for preventive care, routine care, prescription drugs, and more. Make sure to review your policy carefully and know when you can make a claim to get the most out of your health insurance coverage. Knowing when you can claim health insurance is an important part of understanding your coverage and making sure you get the best care for your needs.

When Can Health Insurance be Claimed?

If you’re wondering when health insurance can be claimed, the answer is it depends on the provider and your particular circumstance. Typically if you have a job or are part of a group health plan you can usually start claiming health insurance right away. However, if you’re self-employed or have an individual plan, there are open enrollment periods where you can apply and become eligible. Additionally, if you have a qualifying life event such as a marriage, birth of a child, or loss of a job, you may be eligible to enroll in a plan outside of the open enrollment period. No matter your situation, it’s important to check with your provider to understand when you can start claiming health insurance.

Understanding the Benefits of Health Insurance

Health insurance is a great way to make sure you get the medical care you need and don’t have to worry about the costs. It’s important to understand what benefits you get with health insurance, so you can make sure you’re getting the coverage you need and using it to your advantage. With health insurance, you can get access to a wide range of services like doctor visits, hospital stays, specialist care, and preventive care. You can also get medications and treatments that may not be covered by other plans. Depending on the type of health insurance you have, you may be able to get discounts on certain services or even have the entire cost of a medical procedure covered. Knowing when you can use your health insurance and taking advantage of its benefits can help you get the care you need without breaking the bank.

How to Maximize Your Health Insurance Claim

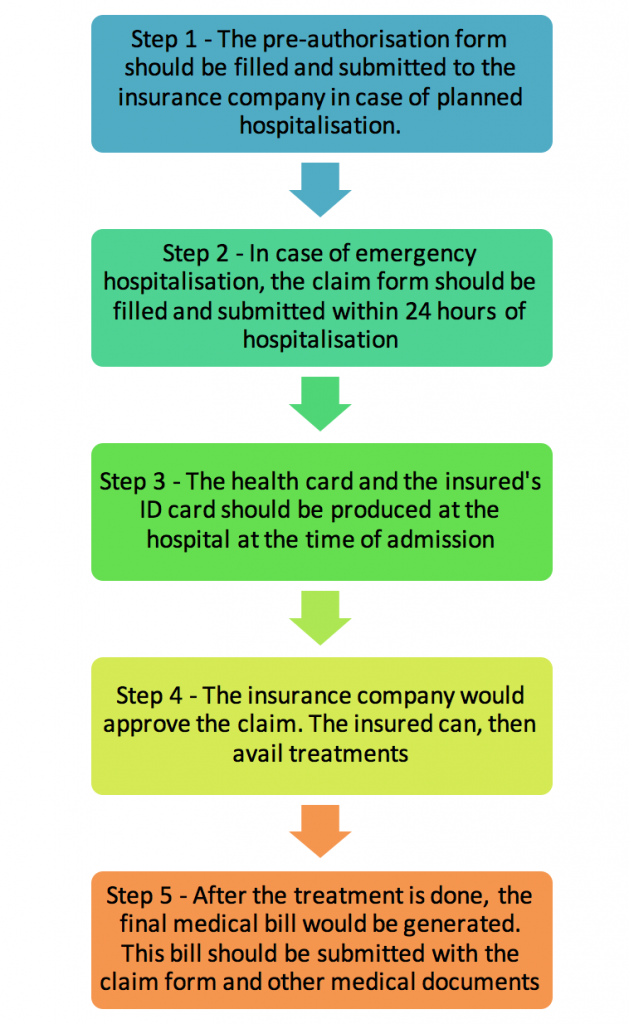

Maximizing your health insurance claim is key to getting the coverage you deserve. Start by understanding what your policy covers and what services are not included. Make sure you are aware of any deductibles and copays that are associated with your plan. Then, think ahead and plan ahead. Schedule your doctor visits, tests, and other procedures in advance to ensure that you are able to take advantage of the full coverage you are entitled to. Additionally, be proactive in seeking out preventative care and treatments, as many health insurance plans cover these services. Finally, keep track of all of your medical bills and expenses, as well as any associated paperwork, so that you can ensure that you are getting the fullest benefit of your health insurance.

Tips and Tricks for Claiming Health Insurance

If you’re trying to figure out when you can claim health insurance, there’s no one-size-fits-all answer. It depends on several factors, including the type of health insurance plan you have, the kind of coverage you need, and the specifics of your current situation. But don’t worry – there are plenty of tips and tricks you can use to make sure you get the coverage you need when the time is right. Start by researching your plan and the coverage it provides. You should also be sure to stay up to date on any changes to your policy, as well as any new coverage options that may be available. Finally, make sure you understand the process for filing a claim – it’s important to know how to file correctly and when the right time is to do so. With these tips and tricks, you’ll be sure to get the coverage you need when the time is right.