If you’re like me, you may have heard the term “coinsurance” in health insurance conversations but had no idea what it meant. As an 18-year-old student, I wanted to learn more about coinsurance and its importance to health insurance so that I could make the best decisions for myself and my family. In this article, I’ll explain what coinsurance is and how it works, so you can make the most informed decisions about your health insurance.

Explaining the Basics of Coinsurance in Health Insurance

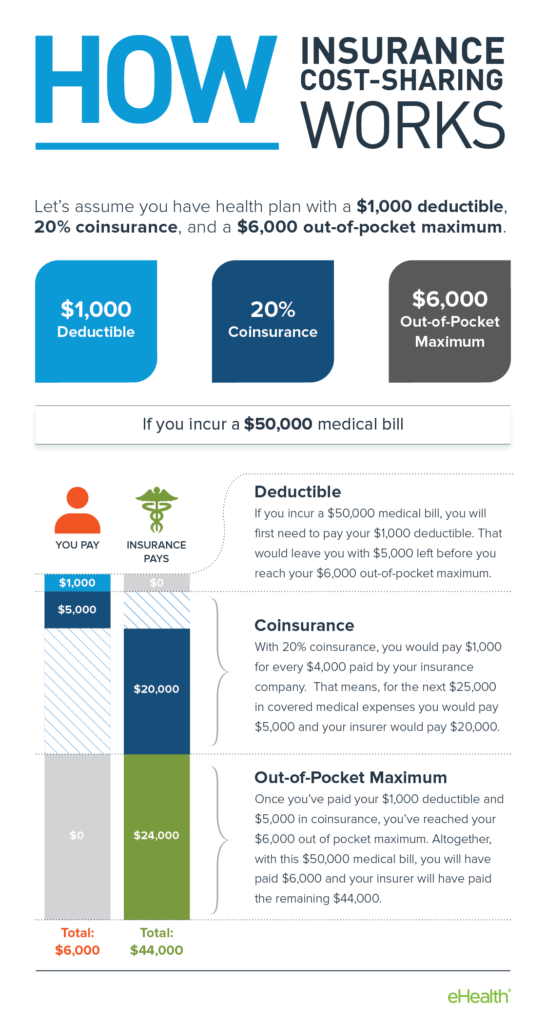

If you’re new to health insurance, you may have heard the term coinsurance and have no idea what it means. Coinsurance is a type of cost-sharing system you’ll see in many health plans. It requires you to pay a certain percentage of your medical bills after you meet your deductible. Generally, your health insurance plan will cover the remaining percentage of your bills. For example, if your coinsurance is 20%, you’ll pay 20% of the bill and the insurer will cover the other 80%. It’s important to note that coinsurance is often different than copayments, which require you to pay a fixed amount for a service. Coinsurance is usually based on a percentage of the total cost of the service.

How Does Coinsurance Affect Your Out-of-Pocket Costs?

Coinsurance affects your out-of-pocket costs by requiring you to pay a percentage of medical bills after you have met your deductible. So, if your coinsurance is 20%, you will pay 20% of the bill and your health insurance will cover the other 80%. This can add up quickly, especially if you have multiple medical bills. It’s important to know your coinsurance rate, because it can have a big impact on your out-of-pocket expenses.

Navigating the Pros and Cons of Coinsurance

Navigating the pros and cons of coinsurance can be tricky for a young adult. On the one hand, coinsurance allows you to pay a lower premium for your health insurance policy. On the other hand, you still have to pay a portion of your medical bills, which can add up quickly. As a 21-year-old, it’s important to weigh out the pros and cons of coinsurance before making a decision. While it may be tempting to opt for a lower premium, the out-of-pocket costs may not be worth the savings. Ultimately, you must consider your health needs, budget, and preferences when deciding whether coinsurance is the right option for you.

Understanding Your Health Insurance Plan’s Coinsurance Requirements

As a 21-year-old, I understand the importance of having health insurance coverage. And one of the key terms I need to understand is coinsurance. Coinsurance is a percentage of the total cost of a medical service that you must pay after you’ve paid your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the cost for a medical service after you’ve paid your deductible. Knowing this information can help you better understand your health insurance plan and make sure you are getting the best coverage for your needs.

Tips for Maximizing the Benefits of Coinsurance in Health Insurance

If you have coinsurance as part of your health insurance plan, there are some tips to maximize the benefits. Firstly, try to pay your coinsurance amount at the time of service. This way, you avoid any potential interest charges. Secondly, you can ask your provider if they offer any discounts or payment plans. Thirdly, you can look into joining a health savings account (HSA). This can help you save money for future health care costs. Lastly, do some research about other plans in your area with lower coinsurance rates. By following these tips, you can help ensure that you get the most out of your coinsurance coverage.