If you’re like me, you’ve probably been wondering what a health insurance premium is and how it works. Well, I’m here to tell you that it’s not as complicated as it sounds. In this article, I’ll explain what a health insurance premium is, how it works, and why it’s important. I’ll also discuss the different types of premiums and the different factors that can affect your premium. So, if you’re a student like me, read on to learn more about health insurance premiums.

Understanding Health Insurance Premiums

Understanding health insurance premiums can be a daunting task. As a 18 year old student, it is important to understand what a premium is and how it works. A premium is a fixed amount you pay for your health insurance policy, typically on a monthly or yearly basis. It is the price you pay for healthcare coverage from your insurance provider and is typically based on factors such as your age, gender, lifestyle, and overall health. Premiums are essential to maintain your health insurance coverage and to access the benefits of your policy.

Calculating Your Health Insurance Premiums

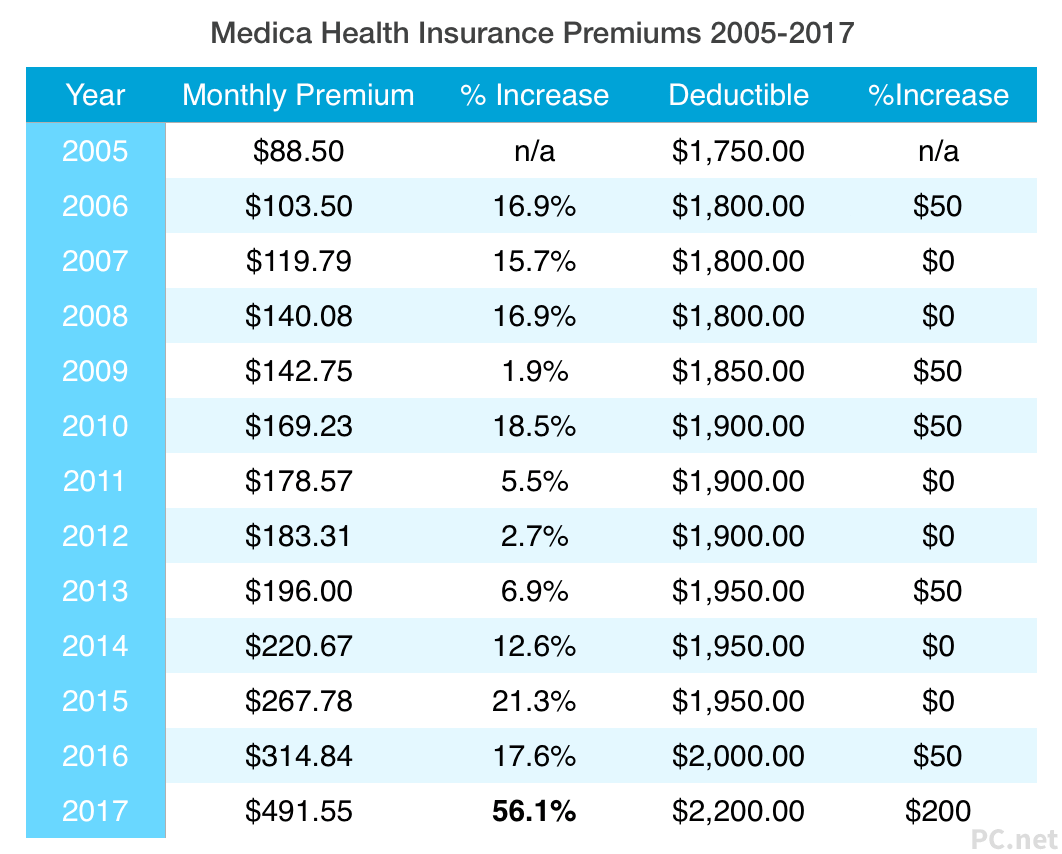

Calculating your health insurance premiums can be a bit tricky. As an 18 year old, you might not really understand the process, but it’s important to understand how much your health insurance will cost you. Premiums are usually calculated by taking into account factors like age, gender, location, and any pre-existing medical conditions. It’s important to double-check your premium with your health insurer to make sure you’re getting the best deal. Knowing your premiums can help you budget, and make sure you get the coverage you need.

Benefits of Paying Health Insurance Premiums

Paying health insurance premiums can be a great way to ensure that you are covered in the event of an unforeseen medical emergency. Not only will it give you the peace of mind that you will be able to get the medical treatment you need, it can also save you money in the long run. By paying your premiums on time, you can avoid costly out-of-pocket medical expenses and get discounts on medical services from your insurance provider. Additionally, you can get access to a range of preventative health services, such as regular check-ups and screenings, which can help you stay healthy and avoid serious medical problems.

Best Practices for Lowering Health Insurance Premiums

One of the best ways to lower your health insurance premium is to shop around. You can compare different insurance plans and their prices to determine the one that fits your budget best. Additionally, look into high-deductible plans that come with lower premiums but higher out-of-pocket costs. If you’re healthy, it’s also a good idea to take advantage of any available health-related discounts, such as wellness programs or preventive care visits. Finally, if you’re young and healthy, you may be able to save money on your premiums by opting for a short-term health insurance plan.

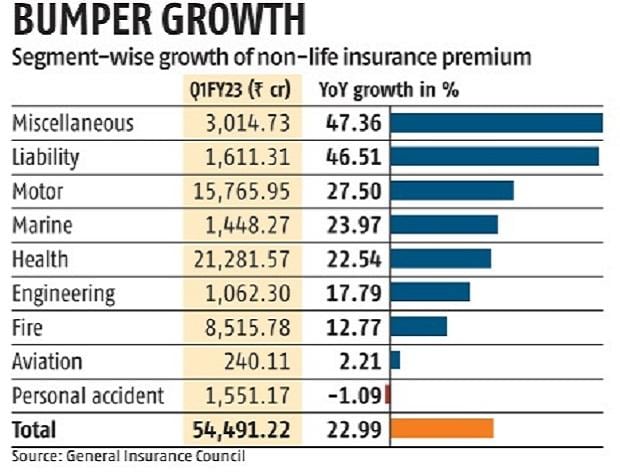

Comparing Different Health Insurance Premiums

When it comes to finding the right health insurance plan, comparing different premiums can be a great way to make sure you get the most for your money. Premiums are the cost of your health insurance plan, and can vary depending on coverage and deductibles. Shopping around is the best way to get an idea of what different providers are offering and get the best deal. It’s important to remember that the cheapest premium isn’t necessarily the best option, so make sure you look at the coverage and any other benefits offered as well.