Medicare health insurance is one of the most important things to have if you’re 18 and just starting out in life. It’s the perfect way to make sure you’re covered in case of any unexpected medical bills or health care needs. With Medicare, you can get access to quality health care at lower costs than you’d normally pay. Plus, you may be eligible for certain preventive services at no extra cost. In this article, we’ll cover everything you need to know about getting a Medicare health insurance plan, from eligibility to coverage options.

What is Medicare Health Insurance and What Does it Cover?

Medicare Health Insurance is a type of health insurance in the US that helps cover medical expenses for people over 65, or those with certain disabilities. It covers some or all of the cost of hospital stays, doctor visits, lab tests, and prescription drugs. Medicare also covers certain preventive services such as flu shots, mammograms, and colorectal screenings. Additionally, Medicare offers coverage for certain in-home services such as physical therapy, occupational therapy, and speech-language therapy, as well as hospice care. It’s important to understand what’s covered and what isn’t so you know what to expect and what to plan for.

How to Determine if Medicare is Right for You

If you’re turning 65 and trying to decide if Medicare is right for you, it’s essential to consider your health care needs. Consider whether you need regular check-ups, prescriptions, or if you need to see specialists. Look at your current health insurance coverage and decide if it’s enough for your needs. See if you’re eligible for any extra subsidies or programs that can help you pay for Medicare. Finally, think about the cost and convenience of getting coverage through Medicare. It’s important to weigh all of these factors before making your decision.

How to Enroll for Medicare Health Insurance

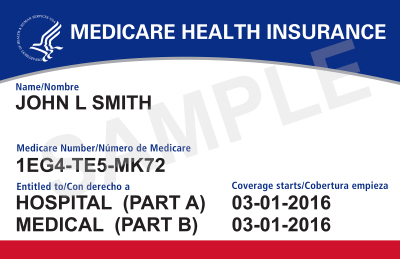

Enrolling for Medicare Health Insurance is easy when you know where to start. As an 18 year old, you can sign up for Medicare three months before you turn 65. All you need to do is visit the official Medicare website, select your coverage plan, and fill out the application form. You can also call their customer service number and talk to a representative if you need help. Once you’ve completed the application, you’ll receive a card in the mail within a few weeks, which is your proof of coverage.

What are the Different Parts of Medicare Health Insurance?

Medicare health insurance has four parts, Part A, Part B, Part C, and Part D. Part A covers inpatient hospital care, skilled nursing care, home health care and hospice care. Part B is for doctor’s services and outpatient care. Part C is private insurance that covers both Part A and Part B, while Part D is a prescription drug plan. Part C and Part D are offered through private insurance companies, while Parts A and B are funded by the government. Depending on your circumstances, you may be able to get all four parts or just one or two of them. It’s important to understand what each part covers in order to make sure you get the right coverage for your needs.

What are the Pros and Cons of Medicare Health Insurance?

Medicare health insurance has pros and cons to consider. On the plus side, it’s comprehensive coverage with an extensive network of providers. It also offers several options, such as Original Medicare, Medicare Advantage, and Medicare Supplement plans. Additionally, it’s a cost-effective option for people over 65 and those with certain disabilities. On the downside, it has deductibles, copayments, and coinsurance. You may also have difficulty finding a provider in rural areas or have limited coverage for drugs. In some cases, the coverage is only available to Medicare recipients, so it may not be the best option for younger individuals.