Are you a 18 year old student who is looking for health insurance but don’t know how much it is? Don’t worry, I got you covered! In this article, I’ll give you all the information you need to know about health insurance, so you can make an informed decision about what’s best for you. From how much coverage you need, to what kind of insurance is best for your budget, I’ll show you all of your options so you can choose the right health insurance plan that fits your needs.

What Factors Affect Health Insurance Costs?

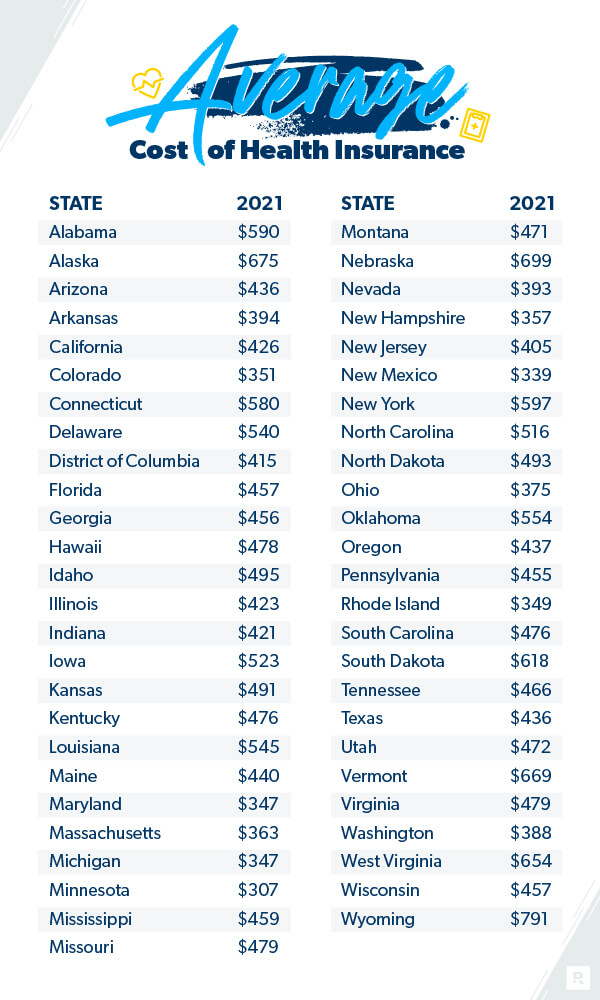

Understanding the factors that affect health insurance costs is important for anyone looking for a plan. Cost can be impacted by age, location, lifestyle, plans/coverage, and more. Things like your age, gender, and whether you smoke can all affect your cost of health insurance. Your location may also have an effect, as well as the type of plan you choose. Some plans may be more expensive but offer more coverage, while others may be cheaper but not cover as much. Factors like the plan’s deductible, co-pays, and co-insurance can also affect the cost of health insurance. As a 21-year-old, it’s important to consider all these factors and find the right plan for my needs and budget.

What Does Health Insurance Cover?

As a college student, I’m always looking for ways to save money. Health insurance is an important way to protect your health and your wallet. It covers a wide range of health care services, from preventive care such as routine checkups to treatments for more serious conditions. Most plans will cover doctor’s visits, hospital stays, prescription drugs, maternity care, mental health services, and more. You can also get coverage for vision and dental care. With so many options available, it’s important to do your research and find out what plan best suits your needs.

How to Find the Best Health Insurance Plan for Your Budget

Searching for the best health insurance plan for your budget can seem overwhelming, especially if you’re a young adult. Fortunately, there are some things you can do to help you find a plan that fits your needs and budget. Start by researching the different health insurance plans available in your area. Make sure to factor in coverage, deductibles, and co-pays. Once you’ve narrowed down your choices, compare the cost of premiums and other out-of-pocket expenses. Be sure to look into any discounts you may qualify for, such as student discounts or employer-sponsored health plans. Finally, make sure to review the plan’s benefits and coverage carefully to make sure you’re getting the best deal.

The Advantages and Disadvantages of Buying Health Insurance

Buying health insurance provides many advantages. It allows you to rest easy knowing that you are covered medically in case of emergency, and it can also provide financial coverage for things like doctor visits and prescriptions. Additionally, it can save you money on taxes, as many insurance policies are tax-deductible. On the other hand, health insurance can be expensive, and the coverage may not always be what you need. Furthermore, you may have to wait for your policy to take effect before you can use it, which can be inconvenient. It’s important to research your options and weigh the pros and cons of buying health insurance before making a decision.

Understanding the Different Types of Health Insurance Plans

There are many different types of health insurance plans available and it can be confusing to know which one is right for you. It’s important to understand the differences between the types of plans so you can make an informed decision about your health care coverage. The most common types of health insurance plans are PPOs (Preferred Provider Organizations), HMOs (Health Maintenance Organizations), EPOs (Exclusive Provider Organizations), and POS (Point-of-Service) plans. PPOs are the most popular and provide access to a large network of healthcare providers, while HMOs offer more affordable premiums and limited choice of providers. EPOs offer a lower-cost alternative to PPOs with fewer providers, while POS plans offer a combination of PPO and HMO benefits. Knowing the differences between these plans can help you decide which type of health insurance is best for your budget and needs.