Health insurance is an important part of life, providing financial protection and peace of mind in the event of illness or injury. But have you ever wondered how health insurance premium is calculated? With so many variables to consider, it can be confusing to understand the basics. In this article, we’ll explore the factors that go into the calculation of health insurance premiums, so you can make informed decisions about your coverage.

Understanding the Different Factors That Impact Health Insurance Premiums

When it comes to figuring out how much you have to pay for health insurance premiums, there are a lot of factors that come into play. It’s important to understand these factors so that you can make an informed decision when it comes to choosing your health insurance plan. The most influential factors that impact health insurance premiums are age, location, plan type, and level of coverage. Your age affects your premiums because the older you are, the higher the cost. Your location also affects the cost of your premiums since the cost of living varies between states. The type of plan you choose and the level of coverage also have an effect on the amount you pay in premiums. Understanding these factors can help you make the best decision for your needs when it comes to selecting a health insurance plan.

Exploring the Variables That Determine Health Insurance Premiums

When it comes to understanding how health insurance premiums are calculated, it’s important to explore the various variables that come into play. Factors like age, gender, location, plan type, and health status all influence the premium an individual will pay for their health insurance. For example, an individual who is older and in a higher risk health category will typically pay more for their health insurance than someone who is younger and in a lower risk health category. Additionally, the type of plan chosen, such as an HMO or PPO, will also impact the cost of the health insurance premium. Furthermore, where an individual lives and the local health care costs can affect the premium as well. By understanding the variables that determine health insurance premiums, individuals can choose the plan that best fits their needs and budget.

Analyzing the Role of Age, Gender and Health Status in Calculating Health Insurance Premiums

Age, gender and health status play a huge role in determining your health insurance premiums. As you get older, you’re more likely to experience health issues, so your premium will likely be higher. Gender can also be a factor in the premiums you pay, as women tend to have more health-related costs than men. Finally, your health status can have a huge impact on your insurance premiums. If you have a pre-existing condition, you may be charged more than someone who is healthy. Premiums can also be higher if you smoke or have a family history of certain medical conditions. It’s important to understand how your age, gender and health status can affect your health insurance premiums and make sure you’re getting the best deal possible.

Examining the Impact of Deductibles and Co-pays on Health Insurance Premiums

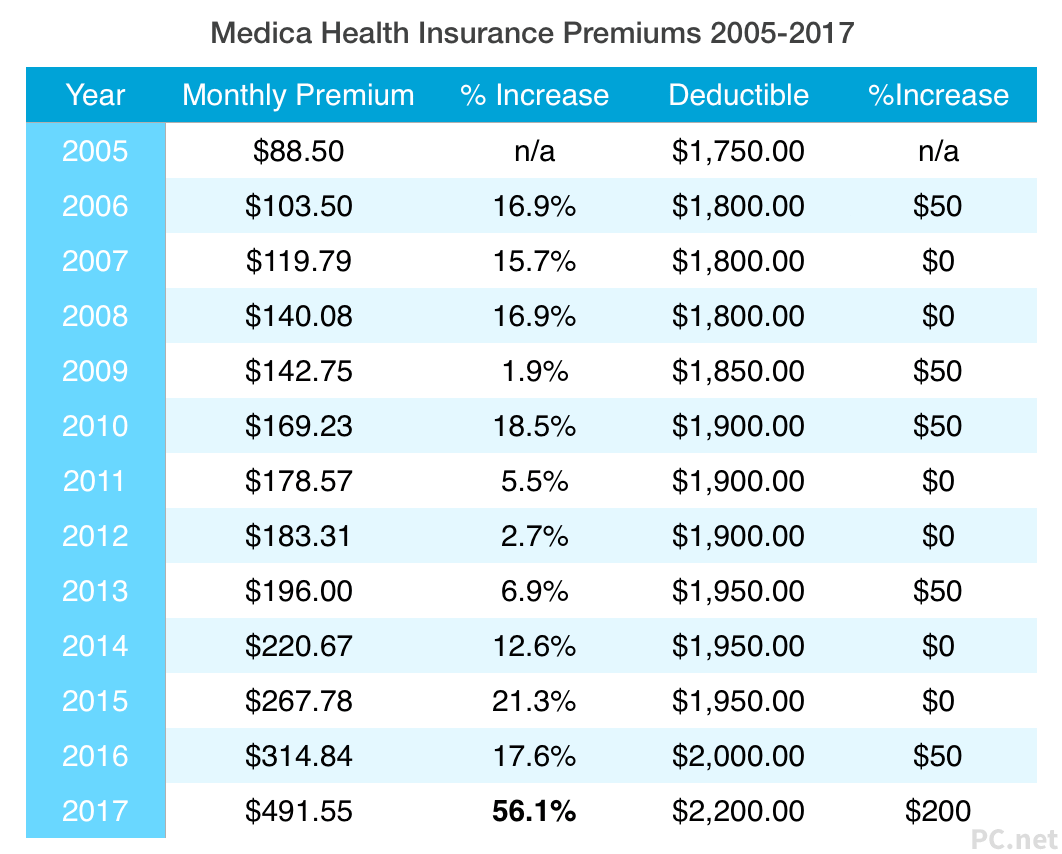

When it comes to understanding how health insurance premiums are calculated, it’s important to consider the impact of deductibles and co-pays. Deductibles are the amount of money you need to pay out-of-pocket before your insurance kicks in and starts covering any expenses. Co-pays are the fixed amount you pay for certain services that your insurance covers. These two factors can have a huge impact on how much you pay for your health insurance premiums. For example, if you have a high deductible, you may pay a lower premium, but you’ll pay more out-of-pocket when you need to use your insurance. On the other hand, if you opt for a lower deductible, you may pay a higher premium but you’ll pay less out-of-pocket when you need to use your insurance. Knowing how these two factors affect your premium can help you make an informed decision about your health insurance plan.

Evaluating the Benefits of Different Types of Health Insurance Plans on Premiums

When it comes to getting the most bang for your buck when shopping for health insurance plans, it’s important to evaluate the benefits of different types of plans. Different types of plans, such as HMO, PPO, and POS plans, have different coverage levels and different premiums: evaluating these plans can help you choose the plan that best fits your needs and budget. HMO plans tend to have lower premiums, but fewer coverage options. PPO plans tend to have higher premiums, but a wider range of coverage options. POS plans are a hybrid between the two, offering moderate premiums and a selection of coverage options. Ultimately, you’ll need to assess the benefits of each type of plan and decide which one will provide you with the best value.