Health insurance companies are an integral part of our healthcare system. But how do they make money? Understanding the ways health insurance companies make money can help us better understand how the healthcare system works and how our own insurance works. In this article, we’ll explore the different ways health insurance companies make their money and how it affects us.

Understanding the Business Model of Health Insurance Companies

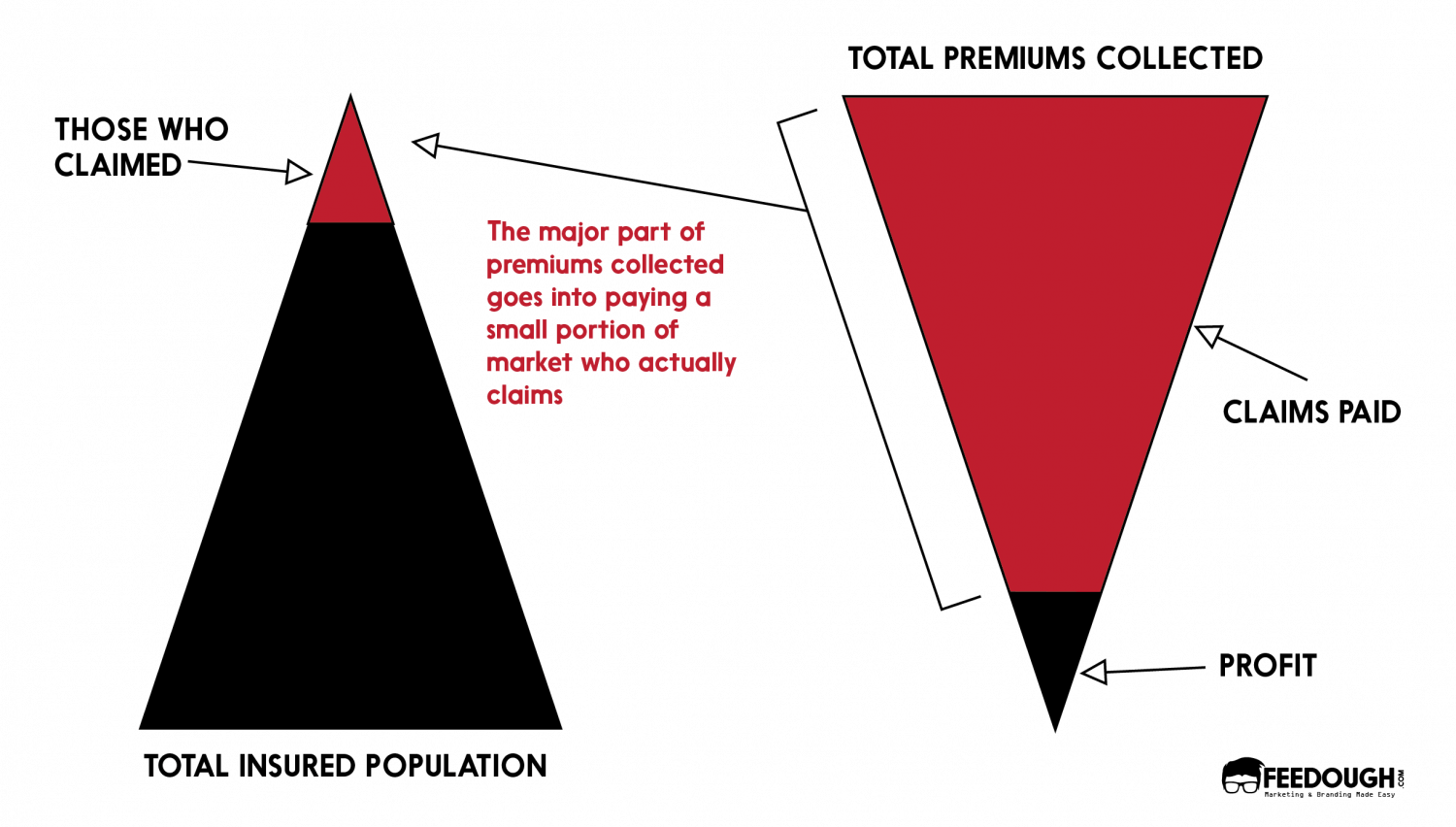

Health insurance companies make money by charging premiums to their customers, which are used to pay for medical services. They also generate income through investments in stocks and bonds, as well as fees charged to providers. Understanding the business model of health insurance companies is key to knowing how they make money. Health insurance companies are able to stay profitable by offering a variety of services to their customers, such as coverage for hospital visits and medication, as well as preventive care services. By providing these types of services, health insurance companies are able to generate a steady stream of income. Additionally, health insurance companies are able to keep their costs low by negotiating contracts and managing administrative costs. Understanding the business model of health insurance companies can help people make informed decisions about their coverage and help them get the most out of their health insurance policies.

Examining Health Insurance Premiums

When it comes to examining health insurance premiums, it’s important to understand the different ways health insurance companies make money. Monthly premiums are one of the primary sources of income for these companies. The higher the premium, the more money they make. Additionally, they generate revenue from investments they make with the money they receive from premiums. They also make money from fees related to enrolling in and using their plans, as well as from fees associated with out-of-network services. Finally, they can also make money from selling consumer data to third parties. By understanding these different methods of generating income, people can get a better handle on how health insurance companies make their money.

Exploring Investment Opportunities for Health Insurance Companies

Health insurance companies have become increasingly savvy when it comes to finding investment opportunities that can help them make money. Many of these investments involve buying stocks, bonds, and other securities, as well as investing in real estate or other tangible assets. By investing in high-yield investments, health insurance companies can gain a steady stream of income to help them offset the costs of providing insurance coverage. Additionally, these companies have also begun to invest in innovative technologies, such as healthcare analytics, to help them better understand the healthcare industry and predict trends. With the right investments, health insurance companies can become a major financial force in the industry.

Analyzing Health Insurance Company Reimbursement Strategies

When it comes to health insurance companies, they make their money by utilizing reimbursement strategies. They are able to get paid by patients, employers, and other organizations to cover the costs of medical services. This includes everything from office visits to surgeries to hospitalizations. By utilizing reimbursement strategies, health insurance companies are able to make sure they are getting paid for the medical services they are providing and are able to make a profit. It is important for health insurance companies to stay up to date on the latest reimbursement strategies so that they can maximize their profits and continue to provide quality healthcare services.

Investigating Other Sources of Revenue for Health Insurance Companies

Health insurance companies are always looking for other sources of revenue to make money. An increasingly popular way for these companies to generate additional income is through investing in the stock market. By investing in stocks, health insurance companies can make money from capital gains and dividends, as well as from stock appreciation. This type of investing allows health insurance companies to diversify their income sources, helping to boost their overall profitability. Additionally, health insurance companies can also make money from investing in bonds and other types of fixed-income securities. These investments are generally deemed to be less risky than stocks and can provide a steady source of income for the company. Ultimately, health insurance companies can make money from a variety of sources and investing in the stock market is just one way that they can increase their bottom line.