Health insurance claims can be confusing and overwhelming to navigate. Understanding how claims are processed is essential to ensure that you get the coverage you need and deserve. In this article, we’ll break down the process step-by-step and explain what to expect when submitting a health insurance claim. With a better understanding of how health insurance claims are processed, you can ensure that you get the coverage you need in a timely manner.

Overview of Health Insurance Claims Processing

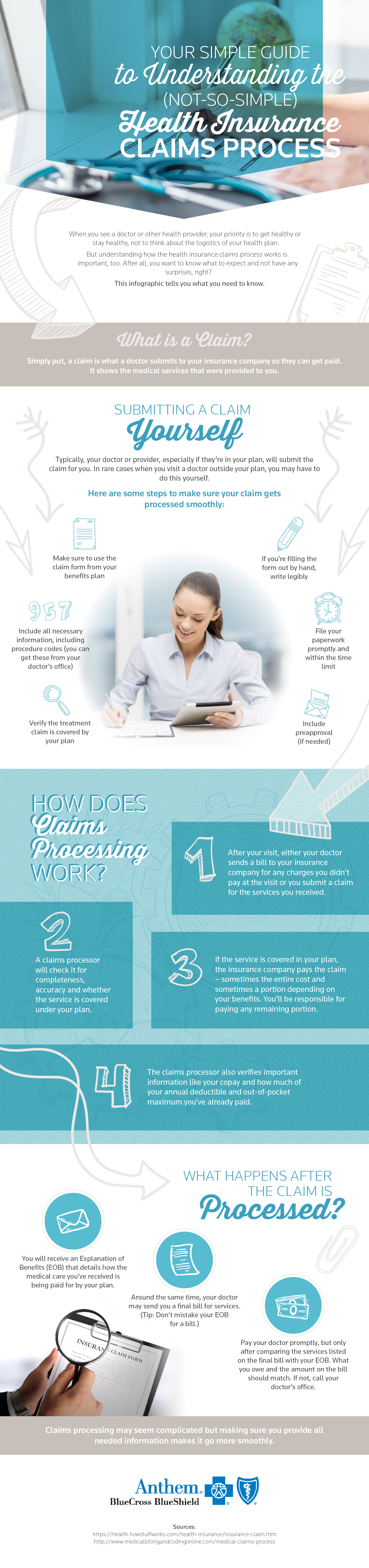

Claims processing for health insurance can be a daunting task for many. It’s important to understand how the process works so you can ensure you are getting the coverage and care you need. The overview of health insurance claims processing takes a look at the steps involved in processing a claim, including filing a claim, verification, reimbursement, and appeals. When filing a claim, you must provide accurate and complete information in order to be reimbursed. The insurer then verifies the information to validate the claim and determine the amount to be paid. Once approved, the insurer pays the provider, and you are reimbursed for the cost of care. If you are denied coverage, you have the right to appeal the decision. Knowing what to expect in the claims process can help you get the care you need, and the reimbursement you deserve.

Understanding the Different Claim Types

Understanding the Different Claim Types is essential to getting a handle on how health insurance claims are processed. Health insurance claims can be broken down into two main types — primary and secondary claims. Primary claims are those that are submitted directly to the insurance company for reimbursement. Secondary claims are those that are submitted to a third party such as a patient’s employer or union. Both types of claims require the same information to be provided, but the process for each is slightly different. Primary claims require an individual to provide personal information such as name, date of birth, address, and Social Security number. Secondary claims require additional information such as the employer’s name, group name, and group number. Knowing the difference between primary and secondary claims can help you navigate the insurance claims process and ensure that your claim is processed quickly and accurately.

Submitting and Managing a Claim

Submitting and managing health insurance claims is a critical aspect of properly managing health care costs. It’s important to understand the process and know the steps to submitting and managing a claim. First, you’ll need to obtain a claim form from your health insurance provider. This form should include all the information necessary to submit a claim. Once you’ve completed the form, you’ll need to submit it to the insurance company. They’ll then review the claim and determine whether or not it’s eligible for coverage. If the claim is approved, the insurance company will issue payment for the services rendered. To manage a claim, you’ll need to keep track of the claim number, the date of submission and the status of the claim. This will help you stay on top of the claim and ensure that it is processed in a timely manner.

Common Reasons for Health Insurance Claim Denials

Health insurance claims can be a challenge to understand and navigate, and if your claim is denied, it can be a major hassle. One of the most common reasons for health insurance claim denials is the lack of prior authorization. This means that if you need a certain procedure done, you need to get approval from your insurance company before you make the appointment. If you don’t, your claim will likely be denied. Another common reason for claim denials is that the service or procedure wasn’t covered by your policy. It’s important to know exactly what services and procedures your health insurance covers, so you don’t end up with a denied claim. Finally, incorrect information on the claim form can also lead to a denial. Make sure all the information you provide is accurate and up to date, or you could be facing a denied claim.

Tips to Ensure a Smooth Claims Process

When it comes to filing health insurance claims, it’s important to make sure you do everything you can to ensure the process runs smoothly. Here are a few tips to help you out: First, make sure you always keep your documents organized and up-to-date. Having your paperwork in order will make it easier to file your claims accurately and quickly. Second, stay on top of deadlines. Missing a deadline could mean you miss out on getting your claim processed. Finally, make sure to double-check all the information you provide. Carefully filling out the forms will help ensure your claim is processed without any issues. Following these tips can help make sure your health insurance claims are processed without any hiccups.