Hey! If you’re like me and you’re 18 years old, you might be wondering what health insurance plans are all about. Well, I’m here to tell you that health insurance plans are an important part of having good health and financial security. In this article, I will discuss the different types of health insurance plans, their benefits, and how to choose the right one for you. So, let’s dive into the world of health insurance plans and figure out what works best for you!

What to Consider When Choosing a Health Insurance Plan

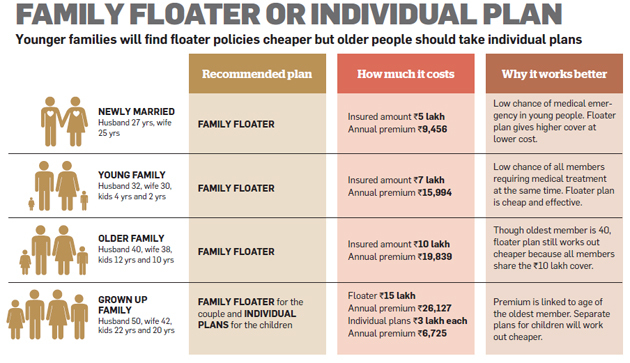

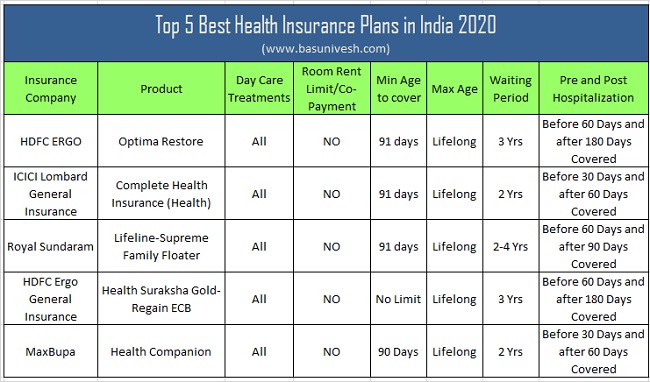

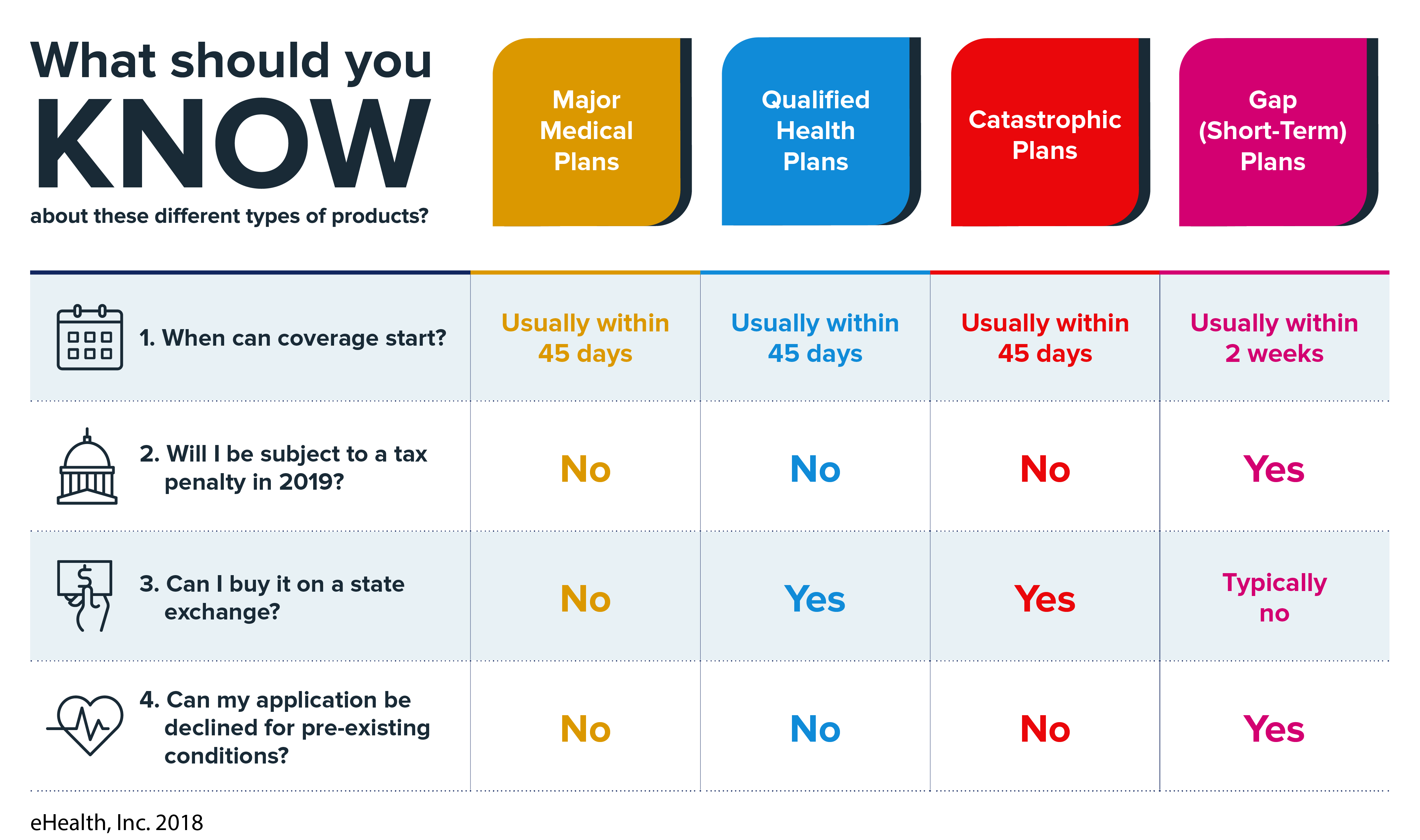

Choosing the right health insurance plan is essential, as it will be responsible for taking care of you and your family’s medical needs. When looking for a plan, it is important to consider its coverage, cost, and network of hospitals and doctors. Additionally, make sure that the plan covers your necessary medications, has no age limit and offers the best price for the services you need. Ultimately, choose a plan that fits your budget and lifestyle, with the coverage that will give you the peace of mind you need.

Benefits of Health Insurance Plans

Health insurance plans are great for young adults like me. They help cover possible medical costs, which can be expensive. With a health insurance plan, I can rest assured that I’ll be covered if I ever need medical care. Plans also often include coverage for things like prescription drugs, preventative care, and mental health services. Having a health insurance plan also helps me save money in the long run, since I’m less likely to have to pay out of pocket for medical expenses. All of these benefits make getting health insurance a no-brainer for any young adult.

Understanding Deductibles and Copays

I’m an 18-year-old student, and I’m trying to figure out health insurance plans. One of the most important aspects of a health insurance plan is understanding deductibles and copays. A deductible is the amount you have to pay out-of-pocket for healthcare expenses before your insurance kicks in. A copay is the fixed amount you pay when you receive medical care. Your copayment is typically a fraction of the actual cost of the service. Deductibles and copays vary from plan to plan, so make sure you understand the details before you choose a health insurance plan.

How to Evaluate Health Insurance Plan Costs

Choosing the right health insurance plan can be overwhelming. It’s important to evaluate costs and benefits when selecting a plan. I’m a 18 year-old student and here are my tips for evaluating health insurance plan costs. First, you need to be aware of how much the premium costs as well as the deductible and copays for services. Second, consider the coverage you need and compare plans to see which offers the most for the cost. Finally, look for additional discounts or rewards programs that may help save money. Evaluating health insurance plan costs is a key factor in making sure you get the best plan for your needs.

Tips for Getting the Most Out of Your Health Insurance Plan

As a student, one of the most important things you can do is to make sure you’re getting the most out of your health insurance plan. Here are some tips that can help you maximize your plan’s benefits. First, be sure to check your policy to understand exactly what it covers. Second, try to stay within your plan’s provider network as much as possible to get the most bang for your buck. Third, take advantage of preventive care options such as immunizations and check-ups. Finally, if you have any questions or concerns, don’t hesitate to contact your insurance provider. By following these tips, you can make sure you’re getting the most out of your health insurance plan.