Health insurance is an important part of everyone’s life. It can help protect you and your family from unexpected medical expenses and provide peace of mind. Whether you are looking for a plan for yourself, your family, or your business, there is a health insurance plan that can meet your needs and budget. With the right plan, you can get the coverage you need and save money at the same time. In this article, we will discuss different types of health insurance plans, their benefits, and how to choose the right plan for you.

PPO (Preferred Provider Organization)

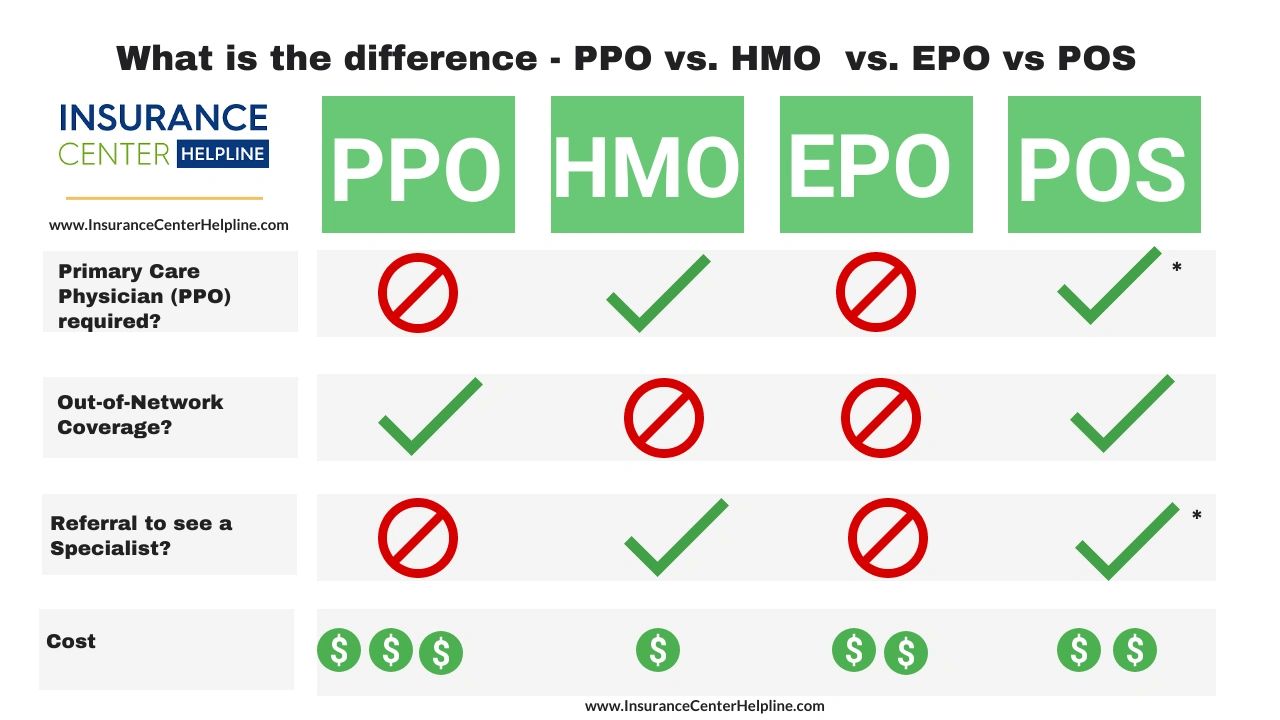

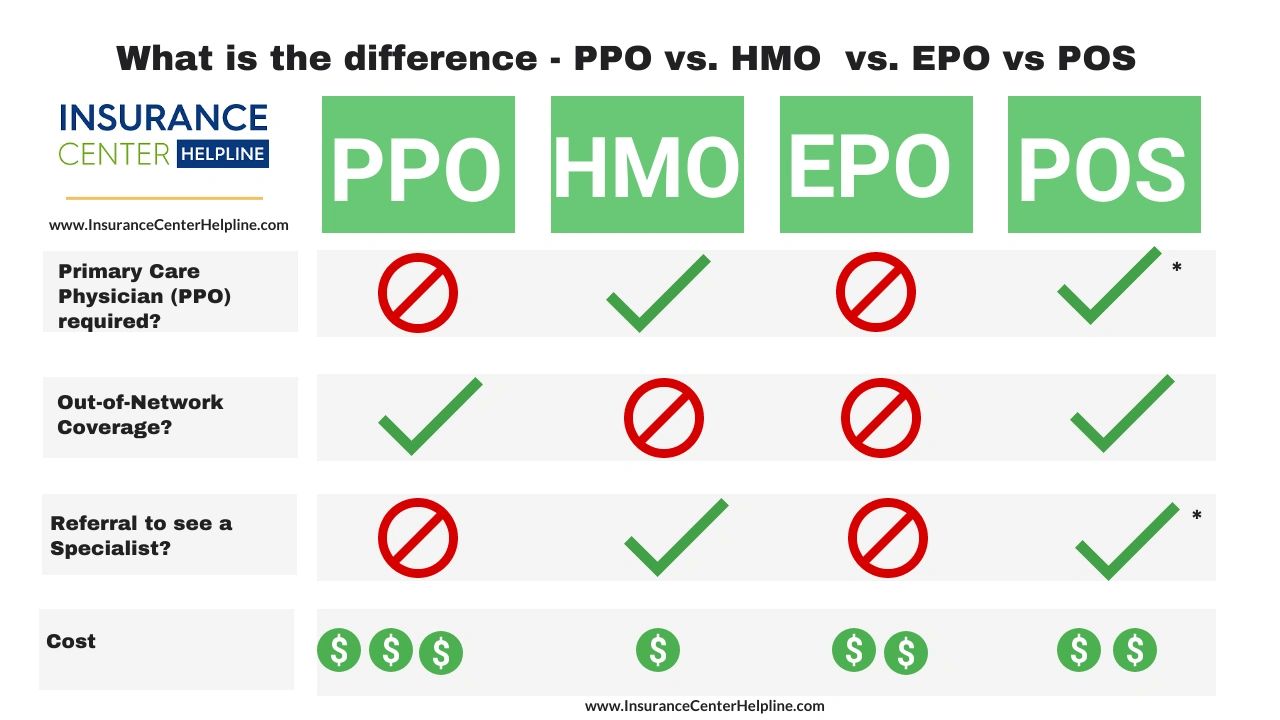

PPO plans are an awesome way to get health insurance coverage. They offer a ton of flexibility, allowing you to see any doctor you want without needing a referral from anyone. That means you can get access to the best care, and you can choose the doctor or specialist that is right for you. Plus, you don’t have to worry about being stuck with a network of limited providers. With a PPO plan, you can get the coverage you need at a price that fits your budget. And with the help of a health insurance advisor, you can find the right plan for your needs. So don’t put off getting the coverage you need – get a PPO plan today!

HMO (Health Maintenance Organization)

Health Maintenance Organizations (HMOs) are a popular option when it comes to picking health insurance plans. An HMO plan is designed to keep costs low by providing preventive care and allowing you to choose a primary care physician (PCP) to coordinate all of your health care needs. With an HMO plan, you will have a set network of health care providers and pay a fixed cost for their services. The fixed cost can be a monthly premium, copayment, or coinsurance. You are also usually required to get a referral from your PCP to see a specialist. One of the best things about HMO plans is that they provide preventive care with no out-of-pocket costs. This means that you don’t have to pay for routine check-ups, vaccinations, and other preventive care services like screenings. An HMO plan is a great option for anyone looking for affordable health care coverage.

POS (Point-of-Service)

POS (Point-of-Service) plans are a great way to make sure you get the healthcare coverage you need. With this type of plan, you pay a copayment for each visit to the doctor, and then the insurance covers the rest. This means that you won’t have to worry about any huge medical bills in the future. Plus, you can typically choose any doctor or hospital, which means you can go to the one that’s most convenient for you. With a POS plan, you don’t have to worry about being stuck in a certain network, so you can get the care you need when you need it. And, since you’re only paying a copayment, you get to keep more of your money in your pocket.

EPO (Exclusive Provider Organization)

EPO stands for Exclusive Provider Organization, and it’s a type of health insurance plan that offers more coverage for in-network providers and less coverage for out-of-network providers. This means that if you go to a doctor that’s in EPO’s network, you’ll get more coverage, while if you see a doctor that’s out of network, you’ll have to pay more out of pocket. EPO plans are great for those who are looking for an affordable health insurance plan with a wide range of coverage options, as they offer a balance between cost and coverage. Plus, they typically have lower out-of-pocket costs than some other types of health insurance plans. So, if you’re looking for an affordable health insurance plan that offers great coverage, an EPO plan may be right for you.

HDHP (High-Deductible Health Plan)

If you’re looking to save money on your health insurance costs while still getting the coverage you need, then a HDHP might be the right choice for you. HDHPs are a type of health plan that have a high deductible, which means you have to pay more out of pocket for medical expenses before your insurance kicks in. However, these plans are usually much cheaper than traditional plans, so you could end up saving a lot of money in the long run. In addition, many HDHPs offer additional benefits such as preventive care and cost sharing, which can help you save even more. So if you’re looking to cut costs while still getting the coverage you need, then a HDHP might be the perfect fit.