Health insurance in Maryland is an important aspect of life for many residents. With the ever-changing healthcare landscape, finding the right health insurance plan can be a daunting task. At Maryland Health Connection, we strive to make the process of selecting health insurance coverage as simple as possible. With our comprehensive coverage options and knowledgeable customer service staff, we can help you find the perfect plan for your needs and budget. Whether you are looking to purchase an individual plan or one for your family, Maryland Health Connection can provide you with the right coverage at an affordable price.

Exploring Health Insurance Options in Maryland

.Exploring health insurance options in Maryland can be overwhelming and stressful. Luckily, there are plenty of resources available to help you determine the best option for your individual needs. Whether you’re looking for an affordable plan, coverage for a pre-existing condition, or a plan that covers a variety of services, there are plenty of options available in Maryland. With the help of online comparison tools, you can quickly and easily compare different plans and select the one that best fits your needs. Plus, you’ll be able to find out what types of coverage are available in Maryland and how much you’ll pay for it. With so many options to choose from, you’ll be sure to find the perfect health insurance plan for you and your family in Maryland.

What to Look for When Shopping for Health Insurance in Maryland

When shopping for health insurance in Maryland, there are a few key factors to consider. Firstly, look at the coverage options available and make sure they meet your needs. Consider the types of services offered and the cost of the premiums. Also, be sure to look at the network of providers included in the plan. You want to make sure that you have access to the doctors and hospitals you prefer. Lastly, take a look at any other benefits the plan may offer, such as a wellness program or discounts on services. Doing your research and taking the time to compare plans will ensure you get the best health insurance for your needs and budget.

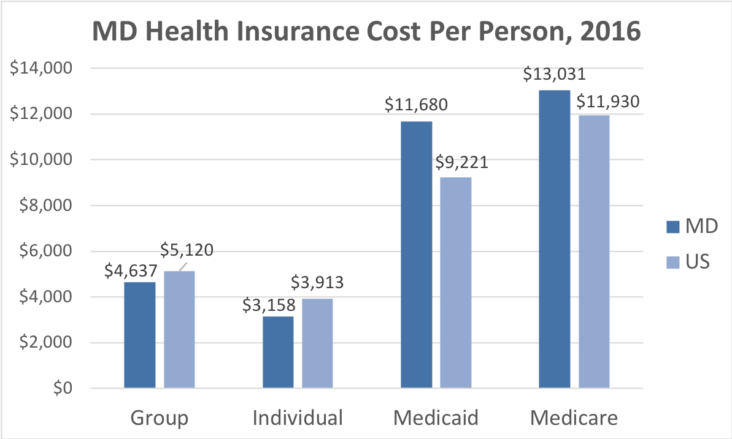

Understanding the Cost of Health Insurance in Maryland

If you’re living in Maryland, it’s important to understand the cost of health insurance. The cost of health insurance varies from person to person, but in general, the cost of health insurance in Maryland can be pretty expensive. Health insurance premiums can range from several hundred dollars per month up to thousands of dollars for more comprehensive plans. Additionally, there are often co-pays, deductibles, and other fees associated with health insurance that can add to the overall cost. It’s important to do your research and shop around to find the plan that works best for you. Working with a professional insurance agent can also help you find the right plan for your needs and budget.

The Benefits of Having Health Insurance in Maryland

Having health insurance is a great way to make sure you’re taken care of in Maryland. With the rising cost of healthcare, it’s important to have a reliable source of coverage that won’t break the bank. By having health insurance, you’re ensuring that you are protected in the event of an unexpected medical emergency or illness. Not only does this insurance give you peace of mind, but it also offers access to quality care, medications, and treatments that may not be available without coverage. Furthermore, having health insurance can help you save money on routine doctor visits and other preventative care. Having health insurance in Maryland is not only beneficial but is essential to your health and well-being.

Tips for Finding the Right Health Insurance Plan in Maryland

Finding the right health insurance plan in Maryland can be a tricky process. It’s important to take your time to research and compare different plans to make sure you’re getting the coverage that works best for you. Here are some tips to help you out: First, it’s important to know what type of plan you’ll need. Do you need a plan that covers just yourself or one that covers a family? Once you know the type of plan you need, you can start to compare different plans offered in Maryland. Make sure to look at both the monthly premiums and the out-of-pocket costs associated with the plan. Also, take a look at what type of coverage the plan offers. This will help you determine if it is the right plan for you. Lastly, make sure to ask questions and make sure you understand the details of the plan before signing up. Taking the time to research and compare plans can help you find the right health insurance plan in Maryland for you and your family.