As an 18 year old student, navigating the world of health insurance can feel like a daunting task. With so many options and rules to consider, it’s easy to get overwhelmed. But don’t worry, understanding health insurance coverage doesn’t have to be a headache. In this article, I’ll break down the basics of health insurance coverage and discuss its importance so that you can make an informed decision.

Understanding What Health Insurance Coverage Includes

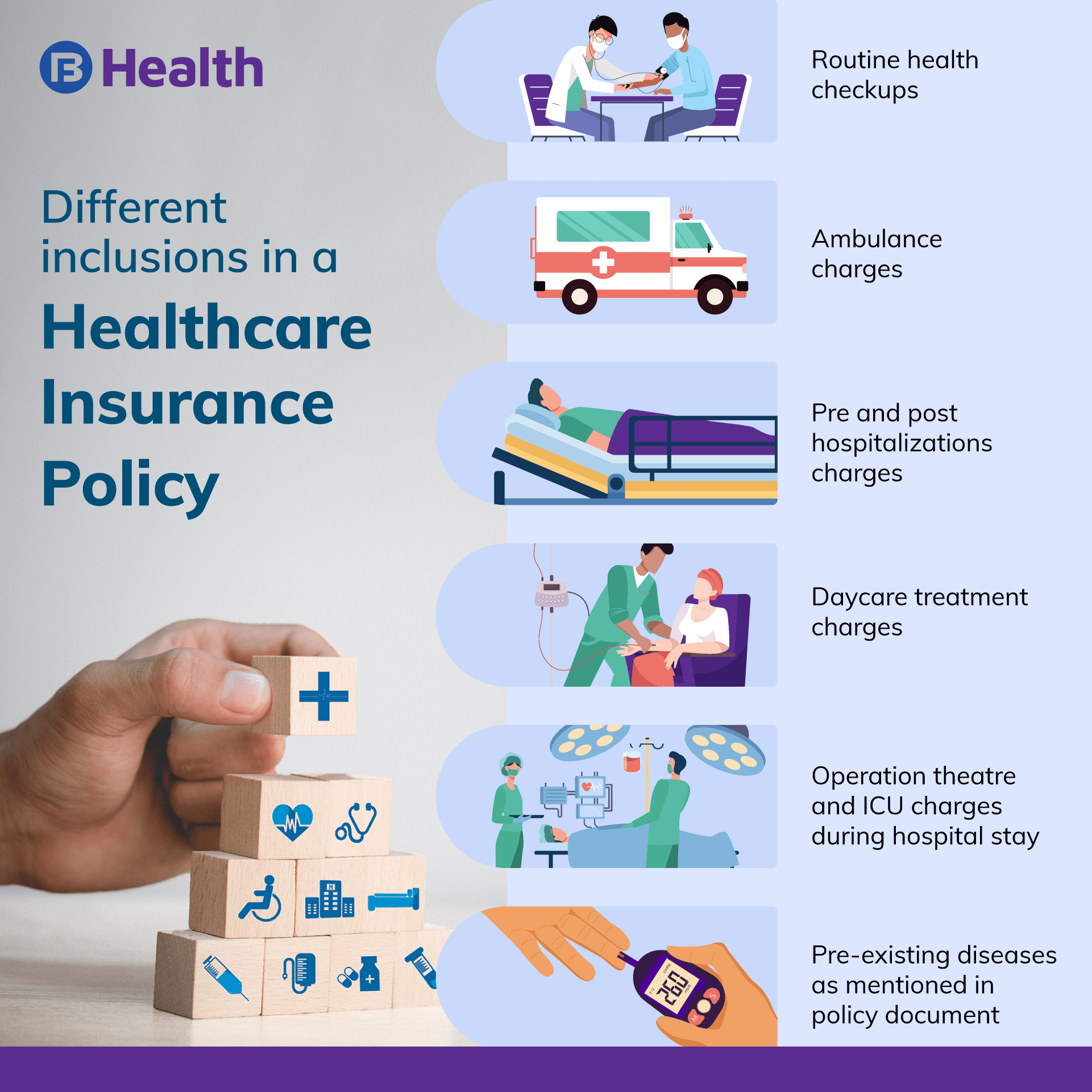

Understanding health insurance coverage can be confusing at first. But it doesn’t have to be! Basically, health insurance coverage refers to the benefits and services your policy provides protection from. It usually includes doctor visits, hospital stays, preventive care, prescriptions, emergency services, and mental health care. Some policies may also cover vision and dental care. Knowing what your plan covers is important so you can make the most of your coverage and be prepared for unexpected medical bills.

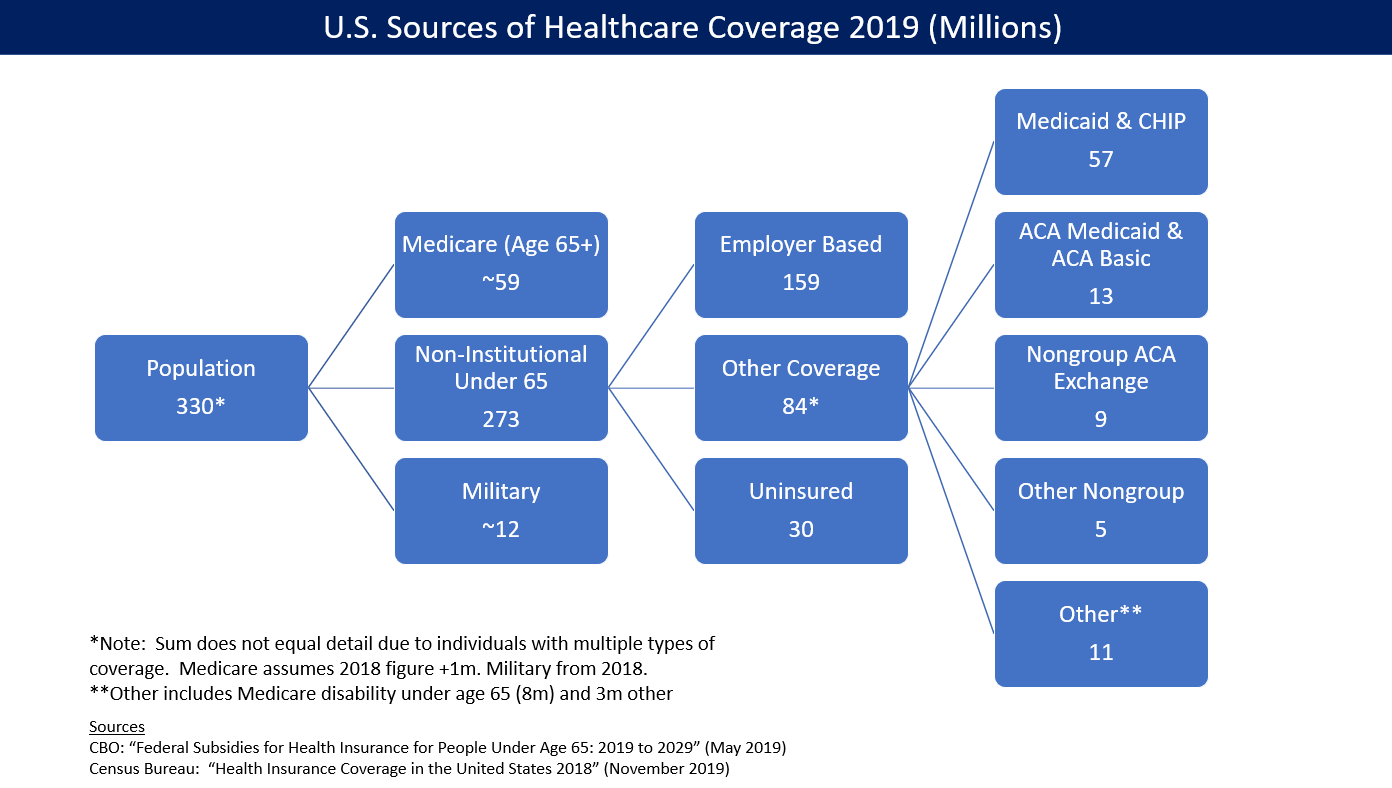

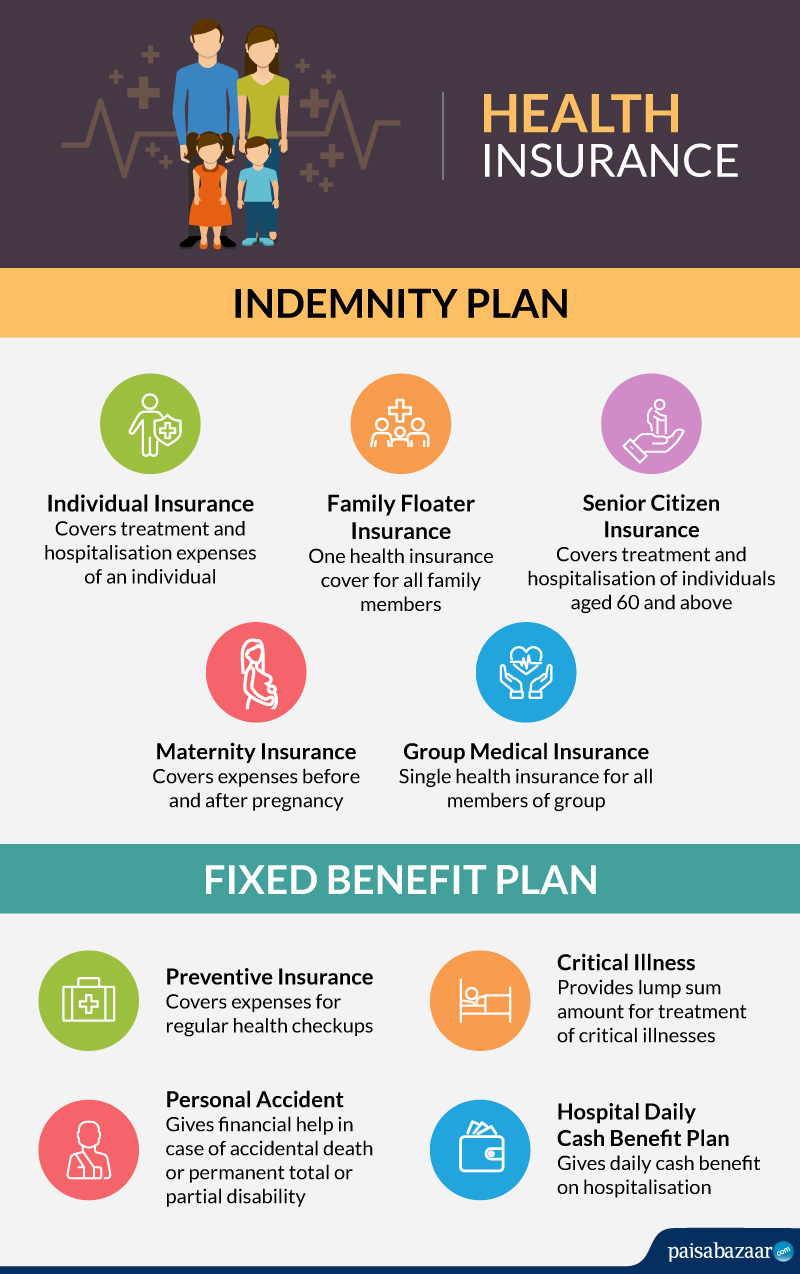

Exploring Different Types of Health Insurance Coverage

Exploring different types of health insurance coverage can be tricky, especially if you’re 18. There are a variety of options available, from employer-sponsored plans to private plans to government-sponsored insurance. Each one has its own advantages and disadvantages, so it’s important to assess your individual needs and budget to determine which type of health insurance coverage is best for you. Additionally, consider looking for plans that offer the most benefits for the lowest cost. Doing your research upfront will help you find the best coverage for your needs.

Exploring Health Insurance Coverage Options for Different Life Stages

When it comes to health insurance coverage, it’s important to explore your options at different life stages. As an 18-year-old student, I’m just beginning to understand the importance of having health insurance. I’m looking into different health plans that are affordable yet still provide me with the coverage that I need. I’m also researching the differences between employer-sponsored plans, private insurance, and Medicaid. With so many options, it’s important for me to weigh the pros and cons of each to make the best decision for my current needs.

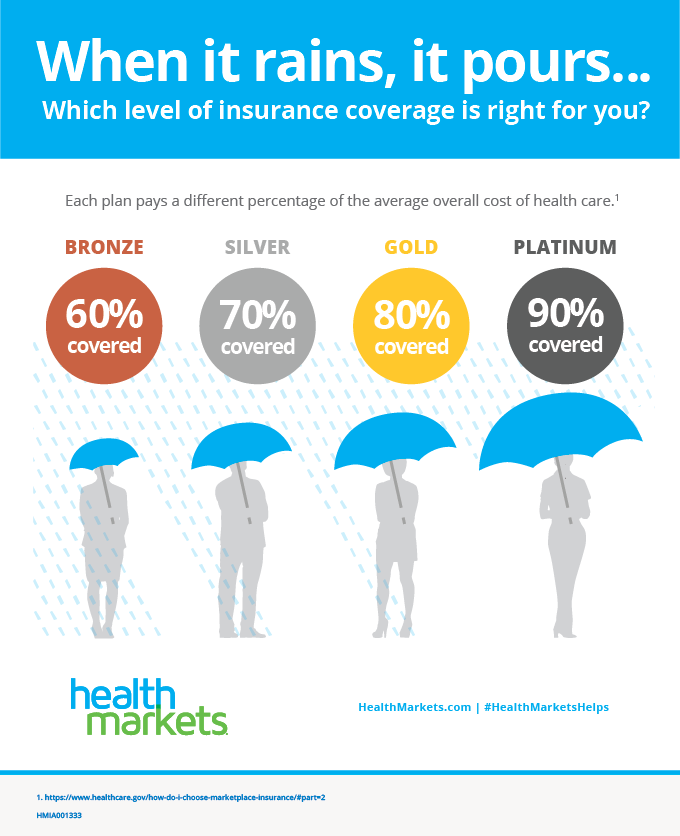

Navigating the Cost of Health Insurance Coverage

Navigating the cost of health insurance coverage can seem overwhelming, especially for young adults just starting out. As a recent college grad, I know how expensive health insurance can be. It’s important to understand the different types of coverage, like major medical, supplemental, and short-term plans. Knowing the different coverage options will help you choose the best plan that meets your needs and budget. Researching and comparing plans can save you money in the long run, and help you make sure you have the right coverage.

Knowing When and How to Utilize Health Insurance Coverage

As a student, I know how important it is to make sure I’m getting the most out of my health insurance coverage. Knowing when and how to utilize it is key. I always make sure to read my policy thoroughly and understand what is covered and what isn’t. I also make sure to keep track of my deductible and my out-of-pocket maximum. That way, I know when to use my insurance coverage to get the best deal. When I need to see a doctor, I make sure to check if they accept my insurance, and if they don’t, I look into other options. Taking the time to understand my coverage and how to use it can save a lot of money and headaches in the long run.