Health insurance is an essential part of life in today’s world. It not only provides financial security and peace of mind, but it also helps ensure that you have access to quality medical care. Whether you choose to go with a private or public plan, there are many factors to consider when selecting a health insurance plan that works best for you. This article will provide an in-depth look at the different types of health insurance coverage, how to pick the right plan, and how to make the most out of your coverage.

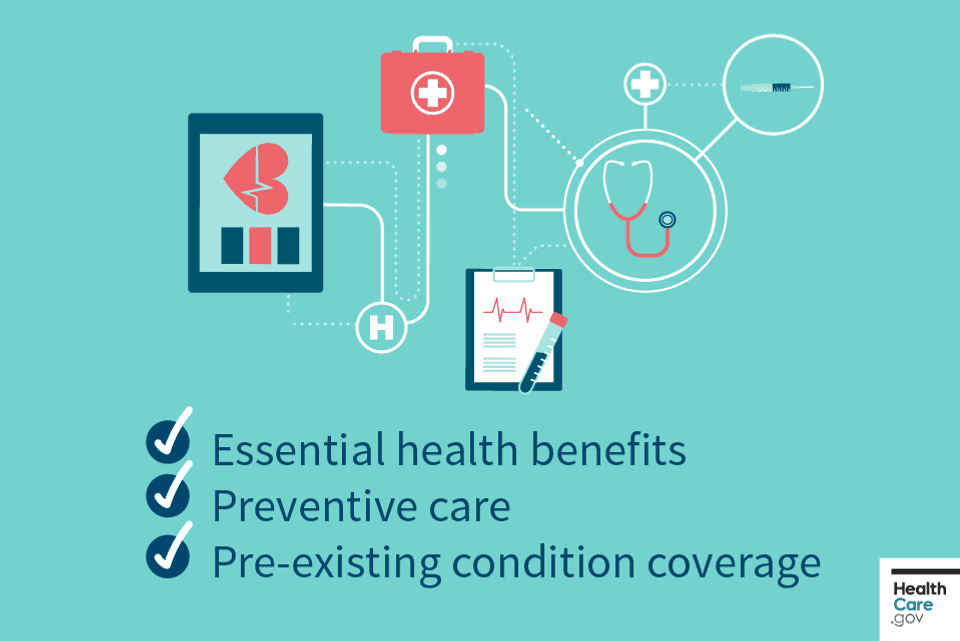

Medical Coverage – Covers costs associated with doctor visits, hospital care, emergency services, prescription drugs, and more.

Medical coverage is a must-have for anyone looking to stay healthy and financially secure. It covers the costs associated with doctor visits, hospital care, emergency services, prescription drugs and more, so you can rest easy knowing you’re covered in the event of an unexpected medical issue. With medical coverage, you can get peace of mind knowing that you won’t be stuck with a massive medical bill, and you can get access to the best treatments and medications for your health needs. Don’t wait until it’s too late – get medical coverage now to make sure you’re always taken care of!

Dental Coverage – Covers preventive care, like check-ups and cleanings, as well as restorative care, like fillings and root canals.

Having dental coverage is so important for keeping your teeth healthy. With dental coverage, you can stay on top of your oral health and get preventive care like regular check-ups and cleanings, and if something goes wrong, you can get restorative care like fillings and root canals. Taking care of your teeth is a must, and with dental coverage, you can make sure your pearly whites stay in top shape. Plus, it’s a great way to save money on dental care – you don’t want to miss out on those awesome dental discounts!

Vision Coverage – Covers eye exams, glasses, and contact lenses.

Having good vision is essential for everyday life, and having vision coverage is a great way to ensure that your eyes are taken care of. Vision coverage can help cover the costs of eye exams, glasses, and contact lenses. This means that you don’t have to worry about breaking the bank when it comes to keeping your eyes healthy. Not only can vision coverage save you money, but it can also help you stay on top of any potential eye problems that may arise. With vision coverage, you can be sure that your eyes will stay healthy and clear for years to come.

Mental Health Coverage – Covers mental health services, such as counseling and therapy.

Mental health coverage is something that shouldn’t be overlooked when choosing a health insurance policy. Mental health services, such as counseling and therapy, can be essential for managing stress, anxiety, and other mental health issues. With mental health coverage, you can get the help you need to work through your mental health issues without having to worry about the costs associated with treatment. Many health insurance policies offer some form of mental health coverage, so make sure to look for this when comparing policies. Don’t let the stress and anxiety of life keep you from getting the help you need. Make sure your health insurance policy provides mental health coverage.

Prescription Drug Coverage – Covers the cost of medications prescribed by a doctor.

Prescription drug coverage is a lifeline for those of us who rely on prescription medications to stay healthy. With this coverage, you won’t have to worry about the cost of your medication, as it will be taken care of. As long as you have a prescription from your doctor, your insurance company will cover the cost, leaving you free to focus on your health. It’s a huge relief to know that the drugs you need to stay healthy are covered, and you don’t have to worry about draining your wallet. Prescription drug coverage is one of the most important aspects of health insurance, and it’s worth making sure you have it.