A good health insurance plan can make a big difference in your life. Not only does it protect your health, but it can also help you save money in the long run. But do you know which section of the law your health insurance can be claimed under? In this article, we’ll explore the different sections of the law that allow you to claim health insurance, so you can ensure you are getting the best coverage possible.

Common Types of Health Insurance Coverage

If you’re looking for health insurance coverage, there are a few common types to consider. The most popular form of health insurance is employer-sponsored health insurance, which is typically offered through your employer. This type of health insurance is typically the most comprehensive as it covers a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs. Other types of health insurance include individual policies, Medicare, Medicaid, and coverage through the Affordable Care Act. Each type of health insurance has its own set of benefits and drawbacks, so it’s important to understand the differences between the different types in order to make the best decision for you and your family.

What Qualifies as Health Insurance Claimable Expenses?

Health insurance is a great way to help cover any medical expenses that may arise. But what qualifies as a health insurance claimable expense? Generally, if you have health insurance, you can claim a wide range of healthcare expenses on your tax return. These expenses can include costs associated with doctor visits, hospital stays, prescription drugs, medical equipment, lab tests, and more. It’s important to note that any costs related to cosmetic procedures or treatments that are not medically necessary are not usually considered claimable expenses. Additionally, you must have received the services or products from a licensed provider in order to qualify for a health insurance claim. Knowing what qualifies as a health insurance claimable expense can help you make the most of your health insurance coverage and save money in the long run.

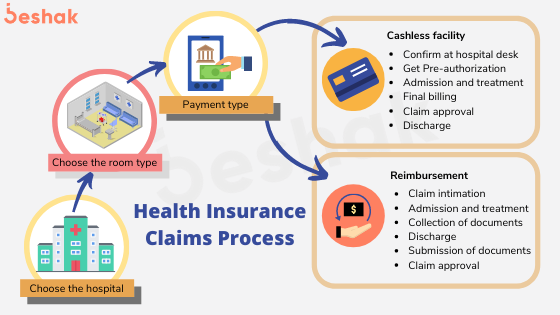

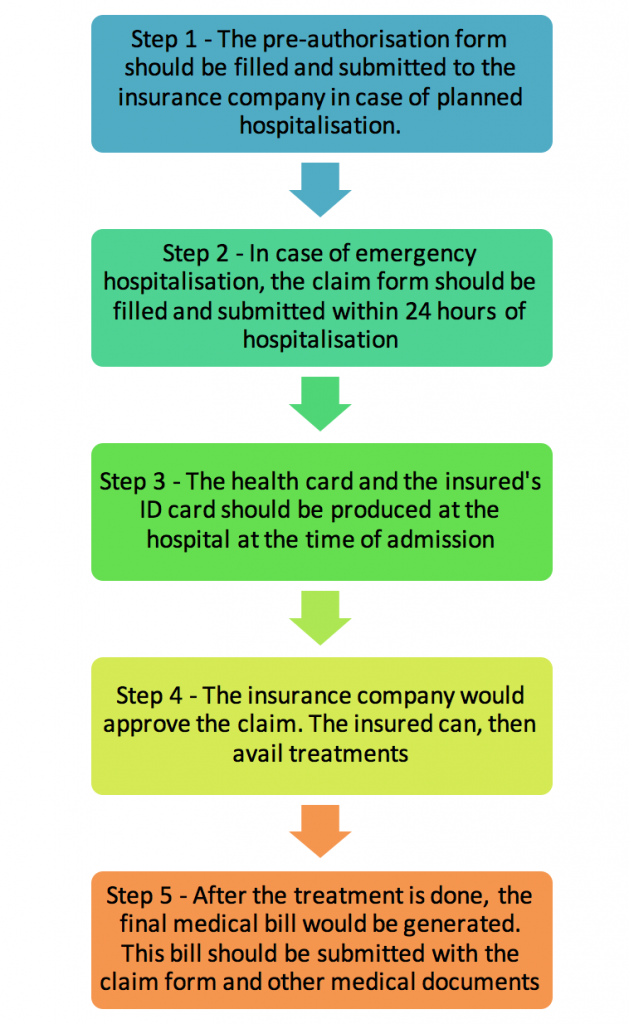

How To File a Health Insurance Claim

Filing a health insurance claim can seem like a daunting task, but with a few simple steps, you can get your claim filed quickly and easily. The first step in filing a health insurance claim is to contact your insurance provider and provide them with the necessary information. You will need to provide information on the services you received, the doctor or hospital you visited, and any documentation related to the claim. Once you have all the required information, you can submit it to your insurance provider. The provider will then review your claim and determine if it is eligible for reimbursement. Once approved, you will receive a notification from your insurance provider informing you of the amount that will be reimbursed. Following these steps can help ensure that you get the most out of your health insurance plan and that you get the coverage you need.

Benefits of Having Health Insurance

Having health insurance is essential for everyone. Not only does it provide peace of mind that you’ll have access to healthcare when you need it, but it also provides you with financial protection if you get sick or injured. Health insurance can help cover the cost of medical bills, prescription medications, and doctor’s visits. It can also provide coverage for preventive care like checkups and screenings, as well as hospital stays and emergency care. Having health insurance can also help you protect yourself from medical debt, which can be a major financial burden. In addition, many health insurance plans include coverage for mental health services, which can be an invaluable resource for those struggling with mental health issues. All in all, having health insurance is a great way to ensure your overall health and wellbeing.

Tips for Choosing the Right Health Insurance Policy

Choosing the right health insurance policy can be a daunting task, especially if you don’t know where to start. Knowing the basics of what health insurance covers and understanding how different policies can benefit you is key in making the right decision. Here are some tips to help you select the best health insurance policy for you and your family: Firstly, consider your current and future needs. Think about which type of coverage you need today and whether or not it will change in the future. Secondly, compare different policies. Different policies offer different levels of coverage, so it’s important to look at all your options. Thirdly, consider what you can afford. Make sure you understand the cost associated with the policy you’re considering, including deductibles and co-pays. Lastly, make sure the policy is flexible enough to meet your needs. Look for a policy that provides coverage for the services you need, while still leaving room for changes in the future. With these tips in mind, you can find the right health insurance policy that fits your unique needs.