Saving money is a top priority for most of us, but when it comes to auto insurance, scrimping on coverage can be a costly mistake. State minimum auto liability insurance policies may seem like a great way to minimize your insurance spending, but in reality, they often leave you at risk of financial loss if you are involved in an accident. With a few key facts, we’ll help you understand why a state minimum auto liability policy isn’t the best idea for most drivers.

State minimum auto liability insurance policies typically do not provide enough coverage to cover the costs of repairs or medical bills in the event of an accident.

Saving money with a state minimum auto liability insurance policy might sound like a great idea, but it usually isn’t. State minimums usually don’t provide enough coverage in the event of an accident. Not only could you be left paying for any repairs or medical bills yourself, but you could also be held liable for any damages caused to the other person. Without enough coverage, you could be facing serious financial consequences if you were to get into an accident. It’s best to make sure you have enough coverage to protect yourself financially, just in case the worst should happen.

State minimum auto liability policies do not provide coverage for damage to your own vehicle.

.It’s easy to see why you might be tempted to go with a state minimum auto liability policy when it comes to car insurance. After all, it’s often the cheapest option on the market. But while it might save you a few bucks in the short term, it’s probably not the best idea. State minimum policies don’t provide any coverage for damage to your own vehicle, which is one of the most important aspects of car insurance. So if you get into an accident and end up having to pay for repairs to your own car, the cost could end up being far more than the money you saved with the state minimum policy. It’s always best to get the coverage you need to protect yourself and your vehicle, even if it costs a bit more in the short term.

State minimum auto liability policies do not provide coverage for other drivers’ medical expenses or property damage in the event of an accident.

If you’re looking to save money on your car insurance, you may have considered getting a state minimum auto liability policy. While it may seem like a good idea in theory, it’s actually not the best way to go. State minimum liability policies only provide the bare minimum coverage required by law, which means they won’t cover medical costs or property damage for other drivers in the event of an accident. This means that if you’re involved in an accident, you could end up paying hundreds – or even thousands – of dollars out of pocket. In the long run, it’s better to get a comprehensive policy that will provide more protection in the event of an accident.

State minimum auto liability policies do not provide coverage for personal injury, such as pain and suffering, or lost wages.

When it comes to car insurance, most people think that having a state minimum auto liability policy is the best way to save money. But when it comes down to it, state minimum auto liability policies don’t provide you with the protection you really need. Not only do they not provide coverage for personal injury like pain and suffering or lost wages, but they also don’t provide protection for damage to your vehicle or other property. When it comes to car insurance, skimping on coverage isn’t the best way to save money. Make sure you get the coverage you really need to protect yourself and your property.

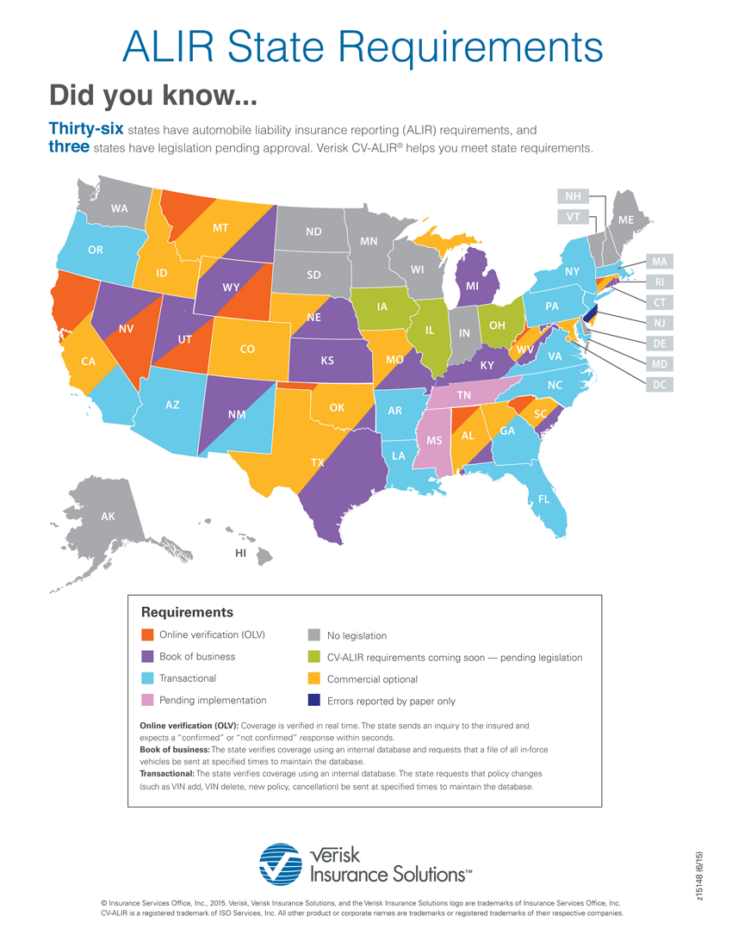

State minimum auto liability policies may not meet the state’s legal requirements for auto insurance, which could lead to fines or other penalties.

When it comes to saving money on auto insurance, it’s tempting to consider buying a state minimum auto liability policy. However, this may not be the best idea. State minimum auto liability policies may not meet the state’s legal requirements for auto insurance, which could lead to fines or other penalties if you are in an accident. It’s important to understand what your state’s minimum requirements are and make sure that your policy meets or exceeds those requirements in order to avoid penalties. Additionally, state minimum policies may not provide the coverage you need in the event of an accident. Consider opting for a more comprehensive policy to ensure that you are fully protected in the event of an accident.