Are you wondering if health insurance premiums are subject to FICA taxes? You’re not alone. Many Americans are confused about the rules and regulations surrounding FICA taxes, and how they may affect their health insurance premiums. In this article, we’ll explore this complex topic and provide an answer to your question. Read on to learn more about whether or not your health insurance premiums are subject to FICA taxes.

What is FICA and How Does it Affect Health Insurance Premiums?

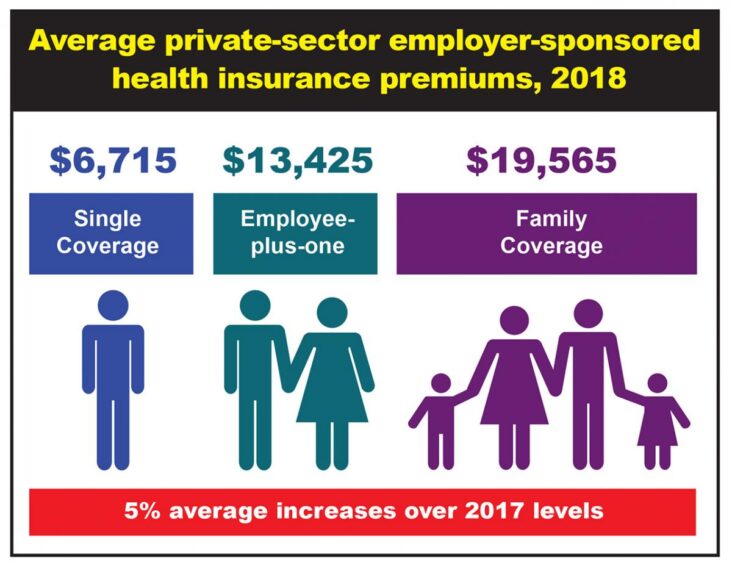

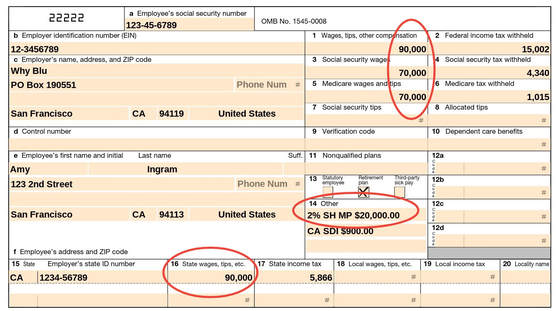

FICA (Federal Insurance Contributions Act) is a tax put in place by the federal government to provide funding for Social Security and Medicare. It’s made up of two parts: Social Security tax and Medicare tax. When it comes to health insurance premiums, FICA can affect the amount you pay. For example, if you have an employer-sponsored health plan, the premiums for that plan may be subject to FICA taxes, meaning that a portion of your premiums goes directly to the government to fund Social Security and Medicare. This can increase the amount you pay for health insurance and can also increase the amount your employer pays in taxes. It’s important to understand how FICA affects your health insurance premiums so you can make the most cost-effective decisions when it comes to your health plan.

How Does FICA Affect the Cost of Health Insurance?

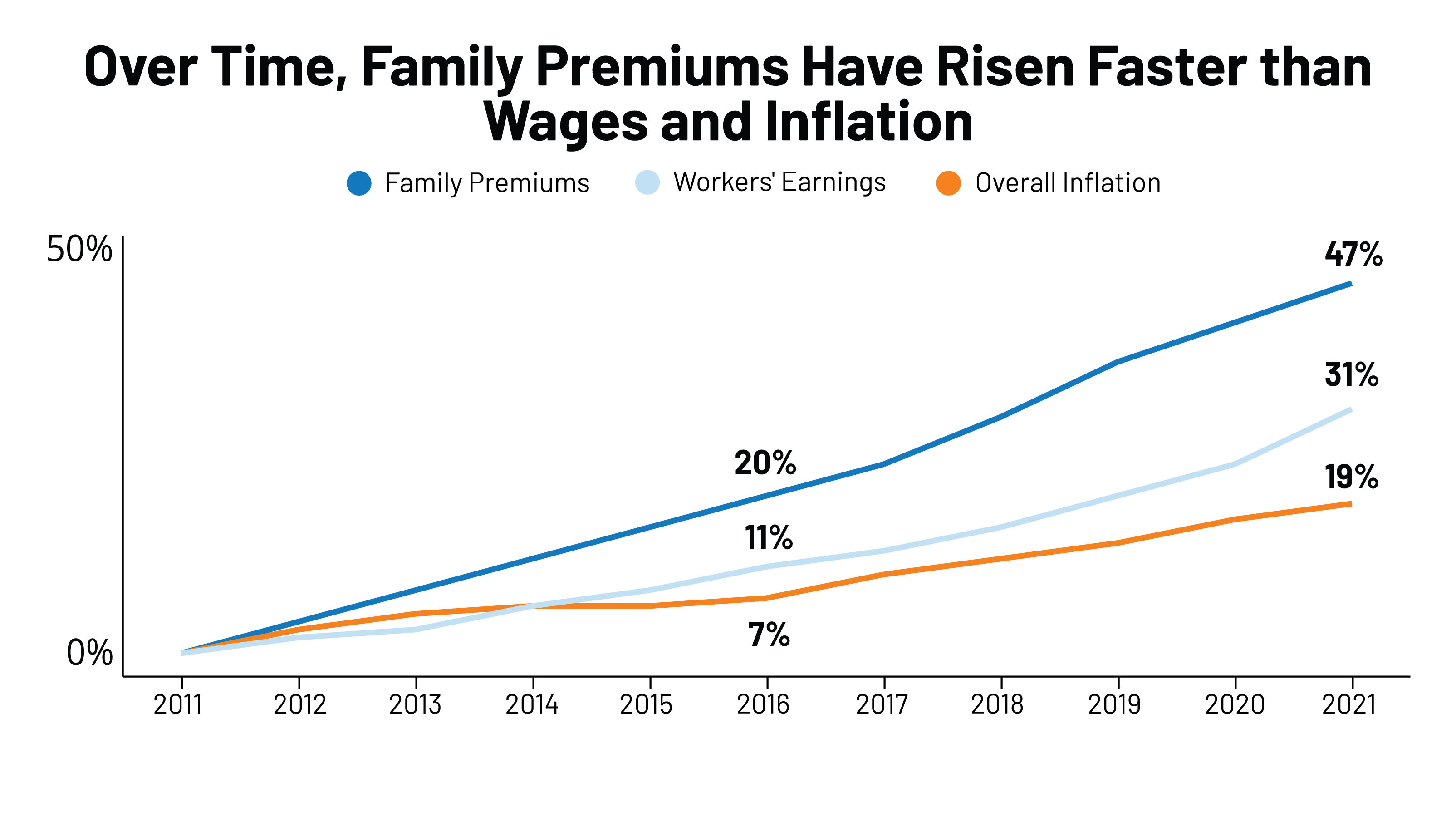

When it comes to the cost of health insurance, FICA can have an impact. FICA stands for Federal Insurance Contributions Act, and it is a payroll tax that is taken from an employee’s salary and used to fund Social Security and Medicare. FICA has a direct effect on the amount of money employers pay to provide health insurance to their employees. Employers are required to pay a portion of the FICA tax, which is then added to the cost of health insurance premiums. This means that the more employees an employer has, the higher their FICA tax rate will be, and the more they will need to pay for health insurance premiums. By understanding how FICA affects the cost of health insurance, employers can better budget for the expense and make sure they are offering the best coverage for their employees.

What Are the Benefits of FICA for Health Insurance Premiums?

FICA is a great way to make sure you’re getting the most out of your health insurance premiums. Not only does it help you save money on your premiums, but it also helps ensure that you’re getting quality coverage. FICA is a federal insurance program that helps to lower the cost of health insurance premiums for those that qualify. It is funded by taxes paid by employers and employees, and it covers a wide range of medical expenses. This means that, with FICA, you can be sure that you’re getting the best coverage for your money, as well as peace of mind that your health care costs are being covered. FICA is an excellent way to make sure that you’re getting the most out of your health insurance premiums, so be sure to look into the options available to you.

How Can Employers Reduce Health Insurance Costs with FICA?

One way employers can reduce health insurance costs with FICA is by offering coverage to part-time employees. By opening up health insurance coverage to part-time workers, employers can spread the cost of coverage across a larger workforce, resulting in lower premiums per worker. Additionally, employers can take advantage of government-sponsored plans such as COBRA, which allows employees to remain on their employer’s health insurance plan after leaving their job. Employers can also explore other options such as health savings accounts, high-deductible plans, and employee wellness programs to reduce the cost of health insurance for their workers. By taking the time to research and explore different plans, employers can find a health insurance plan that fits their budget and their employees’ needs.

What Are the Risks of FICA for Health Insurance Premiums?

Not paying your FICA for health insurance premiums can come with a lot of risks. Aside from the legal repercussions, you could be facing big fines, interest, and penalties for not filing the taxes correctly. Not paying FICA could also mean that you might not be able to take advantage of the tax benefits associated with health insurance. For example, if you have an HSA or an FSA, you won’t be able to deduct those contributions from your taxes if you don’t pay your FICA. This can leave you with a much bigger tax bill than you anticipated. Additionally, if you are self-employed, not paying your FICA could mean that you miss out on important social security and Medicare benefits in the future. It’s important to make sure that you pay your FICA for health insurance premiums to avoid these risks.