Are you asking yourself if your health insurance premiums are pre-tax? You’re in luck! In this article, we’ll explore whether your health insurance premiums are pre-tax, how it affects your overall tax bill, and the benefits of having pre-tax health insurance premiums. We’ll also cover any potential risks associated with pre-tax health insurance premiums and how to make the most of them. So read on to learn more about pre-tax health insurance premiums and how they can be beneficial for you.

What are the Benefits of Paying Health Insurance Premiums Pre-Tax?

When it comes to making the most of your money, one of the best things you can do is to pay your health insurance premiums pre-tax. Not only does this save you money on taxes, it also allows you to take advantage of certain benefits that you would otherwise miss out on. Some of the biggest benefits of paying health insurance premiums pre-tax include lower out-of-pocket costs, greater flexibility in coverage, and more control over your health care spending. With lower out-of-pocket costs, you can save money on medical expenses, while still enjoying the same level of coverage. Flexibility in coverage means you can find a plan that best suits your needs, while still having the ability to switch to a different one if your situation changes. Lastly, having more control over your health care spending allows you to budget for medical expenses without having to worry about the tax implications. Paying your health insurance premiums pre-tax is a great way to save money and get the best coverage possible.

How Can Employers Help Employees Pay Health Insurance Premiums Pre-Tax?

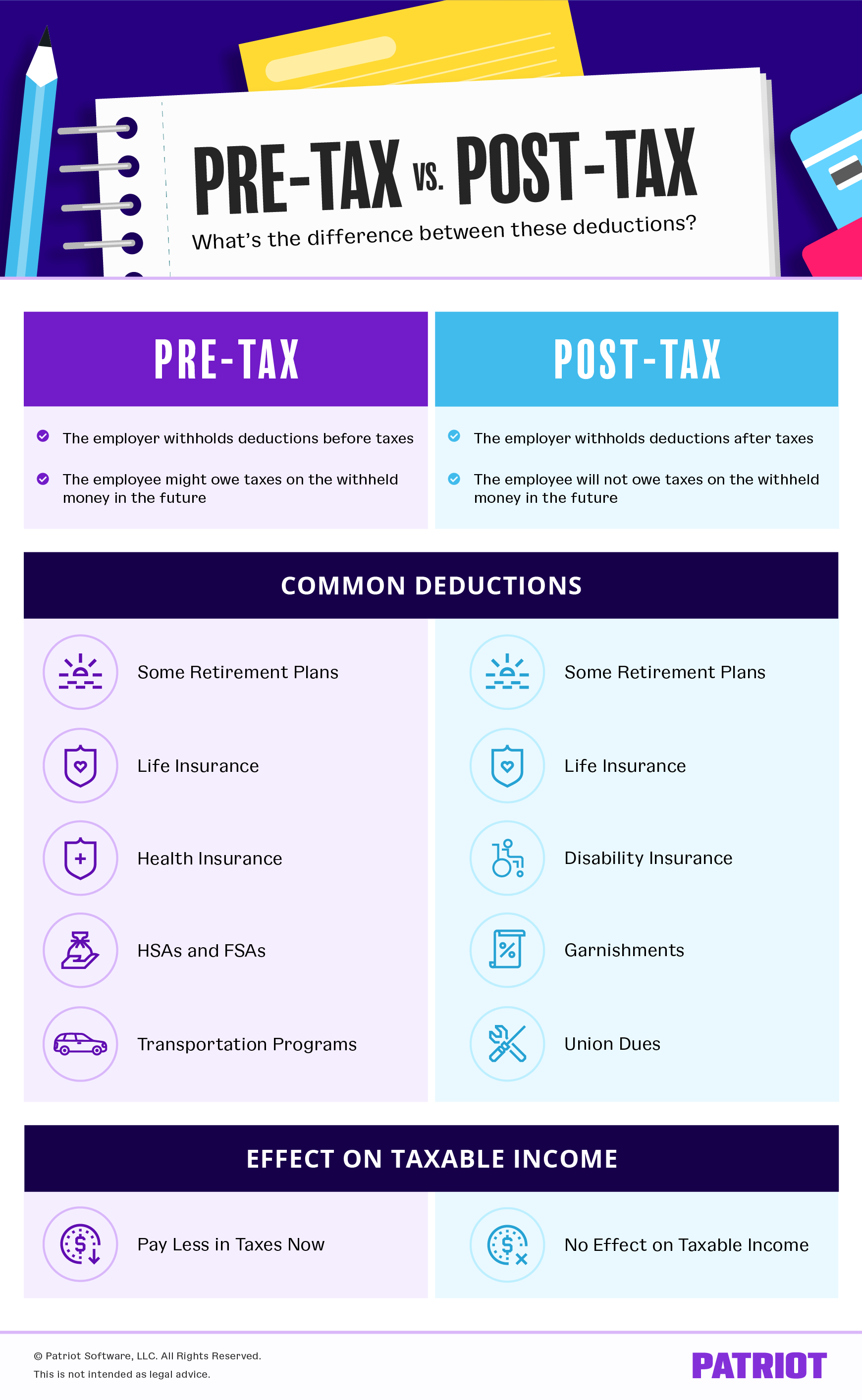

Employers can help their employees pay health insurance premiums pre-tax by setting up a flexible spending account (FSA). An FSA allows employees to set aside part of their salary before taxes are taken out and use the money to pay for qualified medical expenses, including health insurance premiums. This can be beneficial to both the employer and employee, as the employee is able to keep more of their paycheck, and the employer can save money on payroll taxes. Employers can also offer their employees pre-tax health savings accounts (HSA). An HSA is an account that employees can use to save for future medical expenses. Both FSAs and HSAs are great ways for employers to help their employees pay for health insurance premiums pre-tax.

What Are the Drawbacks of Paying Health Insurance Premiums Pre-Tax?

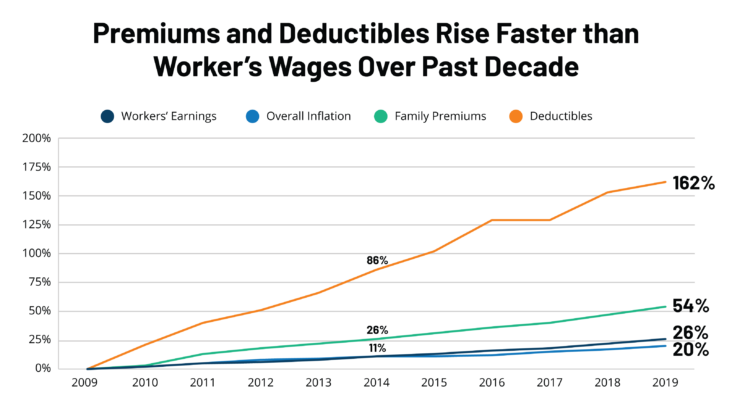

Paying health insurance premiums pre-tax can seem like a great way to save money, but there are some drawbacks to consider. One of the biggest drawbacks is that it can limit your choices for medical coverage. When you pay your premiums pre-tax, you are limited to plans offered through your employer, which can limit your ability to find the best coverage for your needs. Additionally, you are locked into the plan for the duration of the tax year, so you can’t switch to a different plan if you find one that offers better coverage or lower prices. And finally, if your income changes during the tax year, the pre-tax premiums may no longer be the best option for you.

How Can Individuals Pay Health Insurance Premiums Pre-Tax?

If you’re anything like me, you’re always looking for ways to save money on health insurance premiums. One of the easiest ways to do this is by paying your health insurance premiums pre-tax. This way, you can reduce the amount of money you owe in taxes each year, while still making sure you have the coverage you need. Luckily, there are a few different ways you can do this. You can use your employer’s pre-tax health insurance plan, or you can set up an individual pre-tax health insurance plan. However, it’s important to do your research and make sure that you understand the benefits and drawbacks of both options before you make a decision. With the right plan, you can save money on your health insurance premiums and keep more of your hard-earned cash in your pocket.

What Are the Tax Implications of Paying Health Insurance Premiums Pre-Tax?

Paying health insurance premiums pre-tax can be a great way to save money on health insurance costs. The tax implications of paying health insurance premiums pre-tax are important to consider when making this decision. Generally, health insurance premiums paid for with pre-tax dollars are excluded from taxable income. This means that you can save on taxes because you don’t have to pay taxes on the health insurance premiums that are paid with pre-tax dollars. Additionally, if you have a high deductible health plan, you may be able to deduct the premiums you pay pre-tax from your taxable income. This can result in even more savings on your taxes. Ultimately, it’s important to consider the tax implications of paying health insurance premiums pre-tax before making a decision. Doing so could help you save money on taxes, and that’s something everyone can appreciate!