Navigating the Virginia health insurance landscape can be a daunting task. With so many options, it can be difficult to find the right plan for you and your family. Thankfully, we’ve done the research to help you get the most out of your health insurance in Virginia. In this article, we’ll walk you through the best options for health insurance in Virginia, from the major providers to the coverage that best fits your needs. We’ll also cover the key factors to consider when shopping for Virginia health insurance, so you can make an informed decision and get the coverage you deserve.

Overview of Health Insurance Options in Virginia

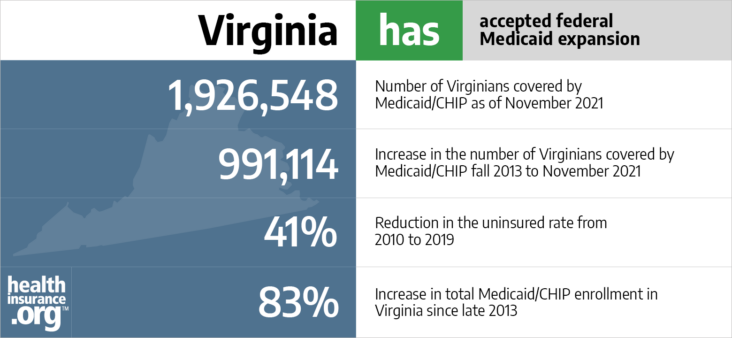

If you live in Virginia, you want to make sure you have the best health insurance available. Virginia offers a wide range of health insurance options for residents, from private insurers to government programs. When it comes to finding the best health insurance for you, it’s important to take the time to research your options and find the plan that meets your needs. Private insurers in Virginia offer plans with different levels of coverage, ranging from basic plans to more comprehensive plans that cover a wide range of medical services. There are also government programs such as Medicaid and FAMIS that provide health insurance for those with low incomes. No matter what your budget or needs are, you can find a health insurance plan in Virginia that is right for you.

What to Consider When Choosing a Health Insurance Plan in Virginia

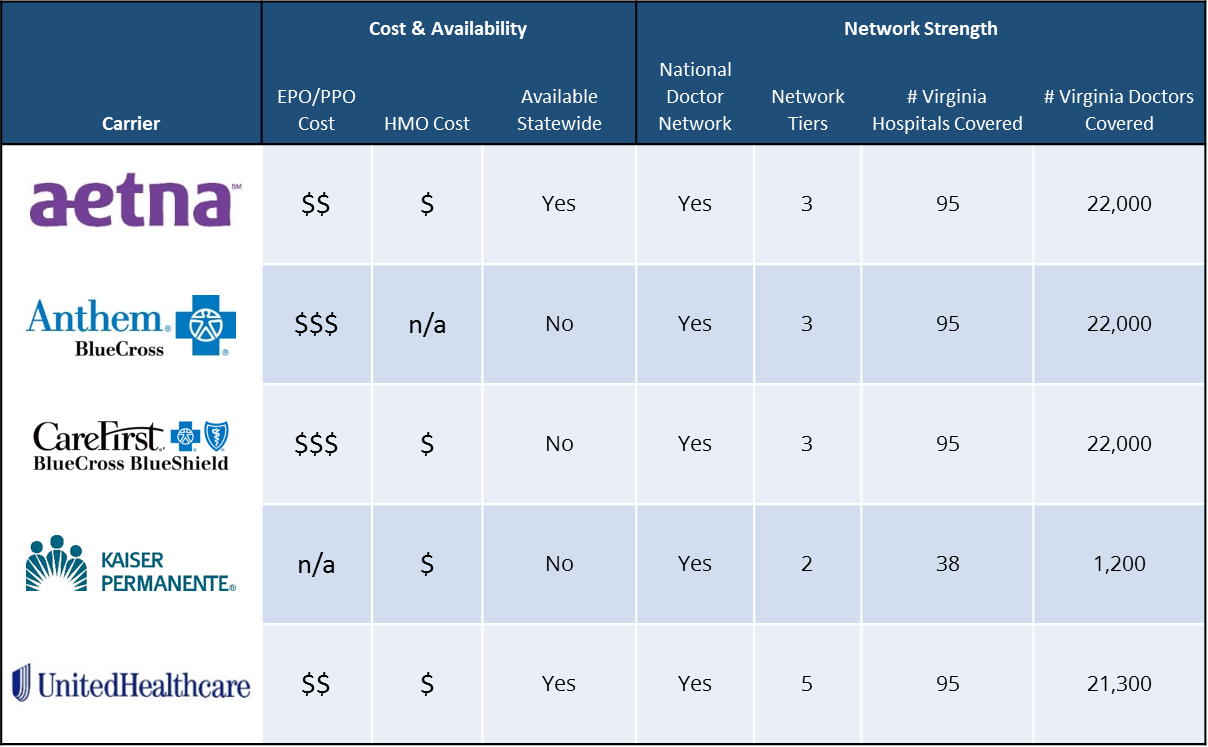

When it comes to choosing a health insurance plan in Virginia, there are a few things to keep in mind. First, it’s important to consider your budget, as some plans can be very expensive. It’s also important to look into the coverage provided by the plan and make sure it meets your needs. Additionally, it’s smart to look into the provider network and make sure the plan includes your preferred health care providers. Finally, it’s important to look at the deductibles and copays to make sure you can afford them. With all of these considerations in mind, you can make an informed decision about the best health insurance plan for you in Virginia.

How to Compare Health Insurance Plans in Virginia

When it comes to comparing health insurance plans in Virginia, it can feel overwhelming! With so many different options, it can be difficult to know what plan is right for you. It’s important to compare plans side-by-side, looking at factors such as coverage, cost, and deductible. You’ll also want to consider the network of doctors and hospitals that are covered by each plan. Once you have narrowed down your options, make sure to read the fine print to understand what’s covered, and what’s not. Ultimately, the best health insurance plan for you is the one that meets your needs and fits your budget. Do your research and take your time – it will be worth it in the end!

Understanding the Benefits of Health Insurance in Virginia

Living in the state of Virginia has a lot of perks, but one of the biggest benefits is having access to quality health insurance. Getting health insurance in Virginia can be a great way to protect yourself and your family from medical bills that can quickly add up. With a variety of plans available, you can choose the coverage that best meets your needs, including coverage for hospitalization, prescriptions, and preventative care. Having health insurance can also help you save money on medical expenses, as many plans offer discounts on certain services. Additionally, the state of Virginia offers several programs that can help you save even more money on health insurance, so it’s worth looking into if you’re interested in saving a few bucks. With all the options available, it’s easy to find a plan that fits your budget and provides you with the coverage you need.

Resources to Help You Choose the Right Health Insurance Plan in Virginia

If you’re looking for health insurance in Virginia, you’re in luck! There are some great resources out there to help you choose the right health insurance plan for you. Start by using the Virginia Department of Health’s website to compare plans and determine the best coverage for your needs. You can also use websites like eHealthInsurance and HealthCare.gov to compare plans and get quotes. If you’re not sure what to look for in a plan, you can ask your doctor for advice or visit your local insurance agent. They’ll be able to provide you with all the information you need to make an informed decision. Don’t forget to read the fine print before signing anything so you know exactly what is covered by your plan. With all these resources, you’re sure to find the perfect health insurance plan for you in Virginia.