Health insurance is a necessary expense for many people, yet the cost of coverage can be prohibitively expensive. From rising premiums to hefty deductibles, it can be difficult to understand why health insurance has become so expensive. In this article, we’ll explore the reasons why health insurance costs have skyrocketed and what you can do to minimize your expenses while still getting the coverage you need.

Rising Cost of Health Care

Healthcare costs have been on the rise for years, and it doesn’t seem like they’re slowing down anytime soon. Over the past decade, the cost of health insurance has skyrocketed, and the reasons for this are varied and complex. Many experts attribute the rise in cost to a number of factors, such as the ever-increasing cost of medical services, the high cost of prescription drugs, and the consolidation of healthcare providers. These factors, in combination with the cost of providing coverage, have contributed to skyrocketing premiums that have left many Americans feeling the pinch. As a result, it’s no surprise that health insurance is becoming more and more expensive.

Limited Insurance Coverage Options

Health insurance can be really expensive, but why is that? One of the main reasons is limited insurance coverage options. With so many different plans and policies, it can be difficult to find one that fits your needs. Additionally, the cost of health care is constantly increasing, driving up the cost of insurance. Furthermore, insurance companies may offer limited coverage options that don’t include the things you need most. This means that you end up paying more for something that doesn’t offer the coverage you need. All of these factors contribute to sky-high insurance costs. It’s important to do your research and find the plan that fits your needs, so you can get the coverage you need at a price you can afford.

High Deductible Health Plans

High deductible health plans can be an expensive way to get health coverage, but they’re often the best option for young people who don’t qualify for lower-premium insurance plans. With a high deductible plan, you pay a lower amount each month, but if you do get sick or injured, you’ll have to pay a higher amount in out-of-pocket costs. This can be a great option for those who don’t need a lot of coverage and are looking for a way to save money on monthly premiums. The downside is that if you don’t have a lot of money saved up and you do get sick, you could be stuck with a big bill. So, it’s important to do your research and make sure you understand the risks before committing to a high deductible plan.

Cost of Prescription Drugs

Prescription drugs can be a huge expense when it comes to health insurance. From brand-name medications to generics, the cost can really add up. It’s important to understand why prescription drug costs are so high and what you can do to reduce them. One of the reasons for the high cost of prescription drugs is the high cost of research and development. Pharmaceutical companies must spend millions of dollars to create, test, and bring a new drug to market, and this cost is passed on to consumers. Additionally, the cost of generic medications can be high due to the cost of manufacturing and the limited number of suppliers. To reduce prescription drug costs, it’s important to ask your doctor about generic options and shop around for the best prices. You may also be able to get discounts through your health plan or through patient assistance programs. Taking advantage of these options can help you save money on prescription drugs.

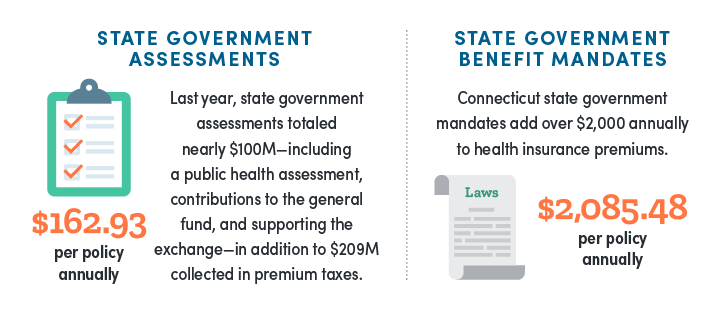

Impact of Government Regulation on Health Insurance Costs

Government regulation is having a huge impact on health insurance costs. In the United States, government regulations are in place to protect consumers and ensure that insurance companies provide adequate coverage. Unfortunately, these regulations can also lead to higher costs for consumers. Insurance companies must comply with the regulations, which can result in higher premiums, deductibles, and other costs. Additionally, the government often sets certain standards that insurance companies must adhere to, and this can also lead to higher costs. The cost of health insurance is a complex issue, but it is clear that government regulation is playing a major role in rising costs.