Are you confused about how health insurance works? Maybe you’re overwhelmed with all the terminology and struggle to know what it all means. Don’t worry, this article will break down the basics of health insurance, answer common questions and explain how it works in an easy to understand way. We’ll also provide some insight into why health insurance is important and how to choose the right plan for you. Keep reading for an in-depth understanding of health insurance and how it can help you stay healthy and safe.

Overview of Health Insurance: What It Is and How It Works

Health insurance is a must-have for any person who wants to make sure they are properly taken care of in the event of an emergency. It basically works by you paying a monthly premium to an insurance provider, and in exchange, they will cover the costs of any medical bills that you may incur. Health insurance can also help with prescription medications, vision care, and even dental care. There are a variety of health insurance plans to choose from, so make sure to do your research and find the one that’s right for you. Having health insurance can provide peace of mind knowing that if something were to happen, you have a fallback to cover any medical costs. With the cost of healthcare on the rise, having health insurance is an absolute must.

Exploring Different Types of Health Insurance Plans

When it comes to health insurance, there are a ton of different options and plans out there, so it can be hard to know where to start. Whether you’re looking for private health insurance, Medicare, Medicaid, or something else, it’s important to understand the different types of plans so you know which one is right for you. Private health insurance plans typically offer more flexibility, but can be more expensive than government-funded plans. Medicare and Medicaid are government-funded health insurance programs for those who meet certain eligibility criteria. Medicare is primarily for people who are 65 and older, while Medicaid is for low-income individuals and families. There are also group health insurance plans offered through employers, as well as short-term health insurance plans, which provide coverage for a limited amount of time. It’s important to do your research and compare plans to make sure you’re getting the coverage you need at the best price.

Understanding Deductibles, Co-Pays, and Other Costs

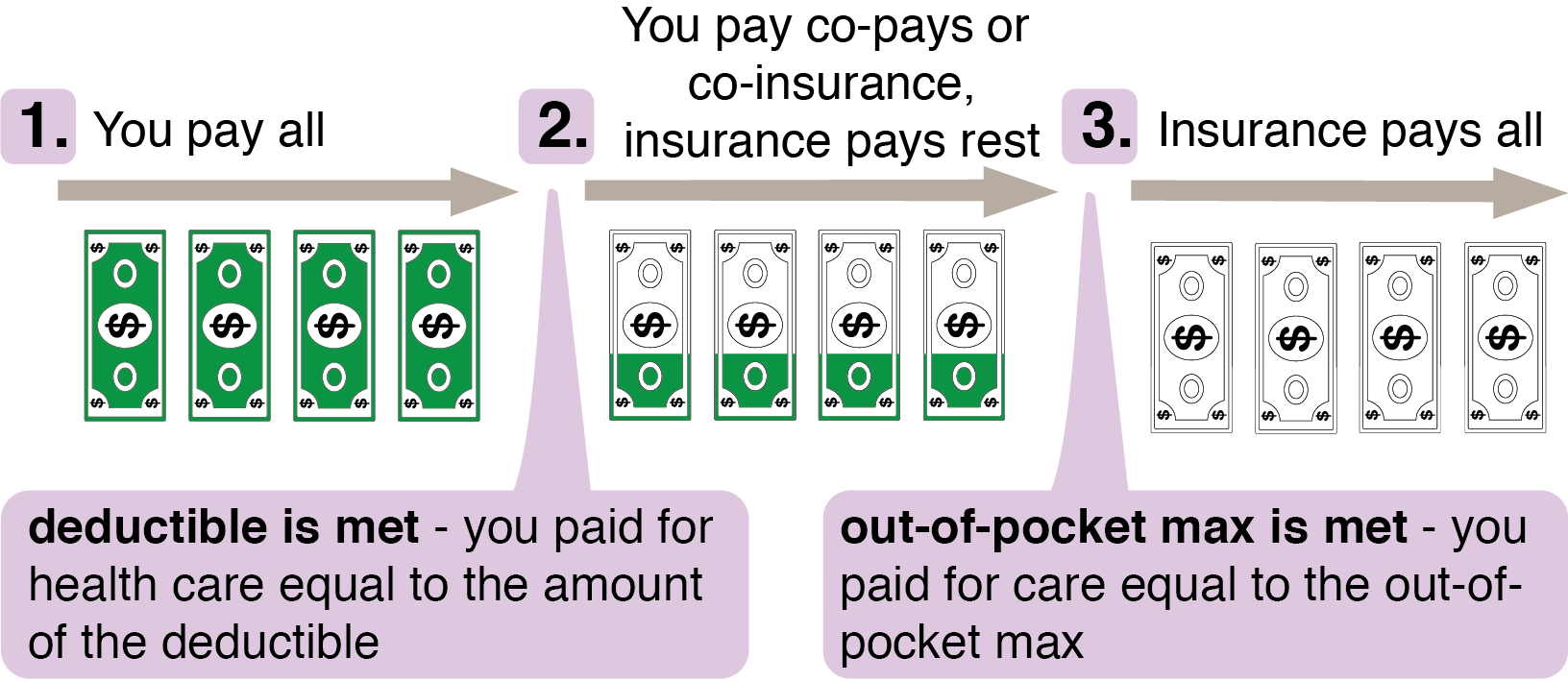

Figuring out your health insurance can be tough, but it’s important to understand the details of your plan if you want to make sure you’re getting the most bang for your buck. Deductibles, co-pays, and other costs are all important pieces of the health insurance puzzle. Deductibles are the amount you must pay out of pocket before your insurance kicks in. Co-pays are a set fee that you must pay for certain services and treatments. Other costs can include coinsurance, which is a percentage of a service or treatment you must pay, and out-of-pocket maximums, which is the most you can pay in a year for services and treatments. Understanding these different costs can help you make the most of your health insurance, so it pays to do your research.

Key Benefits of Health Insurance

Health insurance is one of the best investments you can make in your life. Not only does it provide you with access to quality care and treatments, but it also helps protect you against staggering medical expenses. With health insurance, you can get the care you need without worrying about how you’ll pay for it. Here are some of the key benefits of having health insurance:1. Access to Quality Care: Having health insurance gives you access to the best doctors and facilities, so you know you’re getting the best care possible. And since you’re paying for insurance, you won’t have to worry about paying out of pocket for medical bills.2. Lower Out-of-Pocket Costs: With health insurance, you’ll be able to save money on your out-of-pocket costs. Your insurance company will cover a large portion of the cost of care, so you won’t have to pay as much.3. Peace of Mind: Health insurance gives you peace of mind that you’ll be able to get the care you need, no matter what. Knowing your medical expenses will be taken care of can make a huge difference in your quality of life.Having health

Finding the Right Health Insurance for Your Needs

The first step to finding the right health insurance for you is to know what your needs and goals are. Do you need a plan that covers the basics like doctor’s visits, hospital stays, and prescriptions? Or do you need more comprehensive coverage for things like mental health care, long-term care, or vision and dental care? Knowing what you need and what your budget is will help you narrow down the best plan for you. It’s also important to understand how health insurance works. Make sure you know the differences between an HMO, PPO, and POS plan, as well as the similarities. Researching the coverage, deductibles, co-pays, and out-of-pocket maximums of each plan can help you find the plan that best meets your needs and budget.