Are you trying to save on your taxes and healthcare costs? You may be able to deduct your health insurance premiums on your tax return. Learn how to take advantage of this tax benefit and potentially save hundreds or even thousands of dollars.

What Types of Health Insurance Premiums Can Be Deducted?

If you’re thinking about taking advantage of the tax benefits that come with deducting your health insurance premiums, you should know that not all types of health insurance premiums qualify. Generally speaking, you can deduct premiums for medical, dental, and long-term care insurance policies. This deduction applies to you, your spouse, and any dependents you have. It’s important to note that you can only deduct premiums that you pay out of pocket — premiums that are paid through an employer are not eligible. Additionally, you can only deduct the amount of the premiums that exceed 10% of your adjusted gross income. This deduction can be incredibly valuable, so it’s important to make sure you’re taking advantage of it if you can.

How to Deduct Health Insurance Premiums on Your Taxes

If you’re looking to get the most out of your tax return, deducting health insurance premiums can be a great way to get some extra cash back. Deducting health insurance premiums on your taxes is a relatively easy process, and can save you a ton of money in the long run. The best way to get the most out of your deductions is to make sure that you’re taking advantage of all the available deductions, such as deducting premiums paid for medical, dental, and vision care. Additionally, you’ll want to make sure that you’re getting the most out of any deductions or credits that you qualify for. Finally, don’t forget that you can also deduct premiums for long-term care insurance. With a little research, you can make sure that you’re getting the most out of your deductions and putting more money in your pocket at the end of the year.

What Are the Benefits of Deducting Health Insurance Premiums?

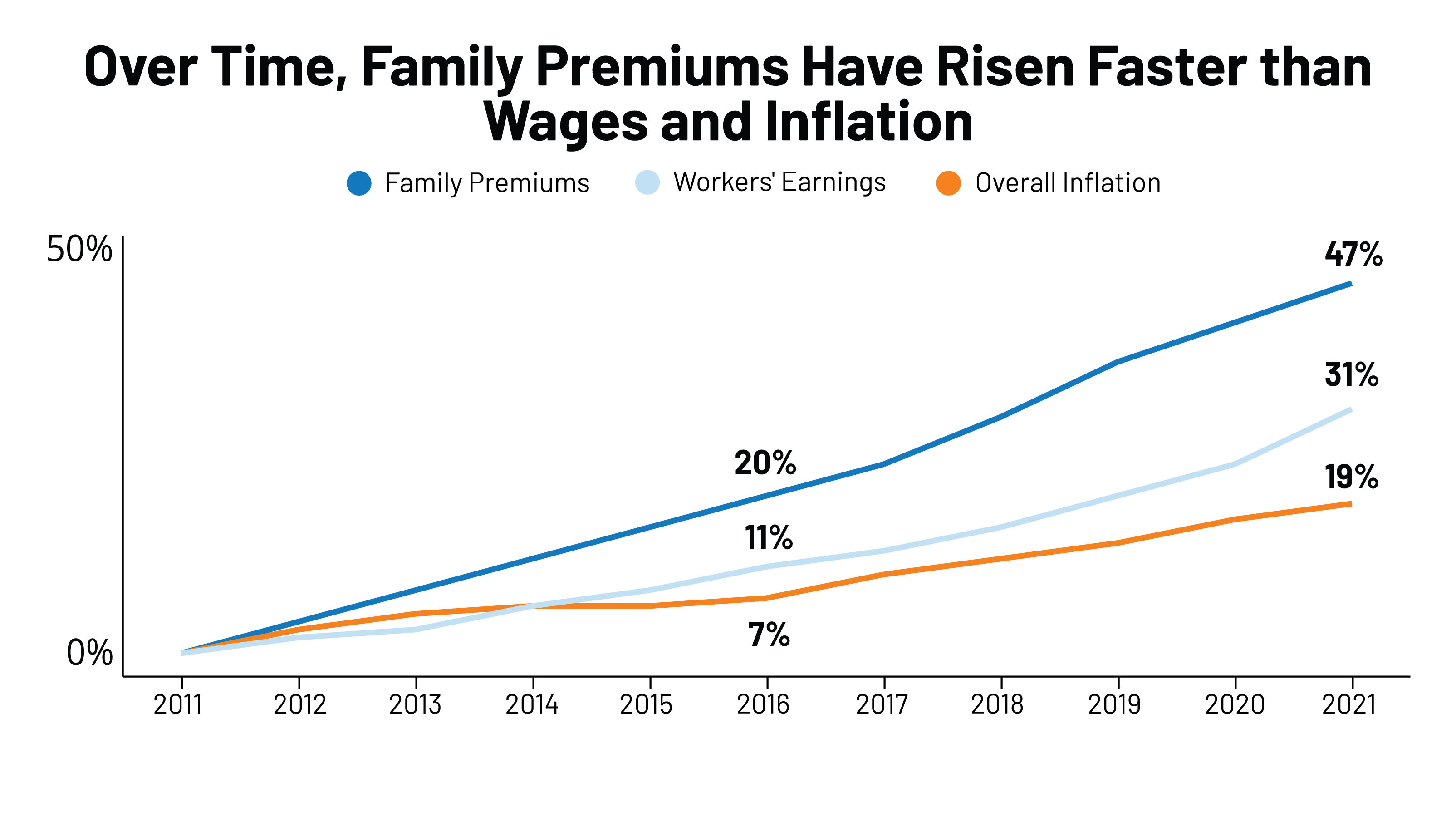

.If you’re looking to save money on your taxes, deducting your health insurance premiums can be a great way to do it. Deducting your health insurance premiums has a number of benefits, including reducing your taxable income, potentially qualifying you for credits or deductions, and helping you save money on your taxes. By deducting your health insurance premiums, you can put some of that money back in your pocket and spend it on other things. Additionally, the peace of mind that comes with knowing your health is covered is invaluable. Deducting your health insurance premiums is a smart move that can help you save money on your taxes and ensure that you’re covered in case of any medical emergencies.

How to Determine the Deductible Amount for Health Insurance Premiums

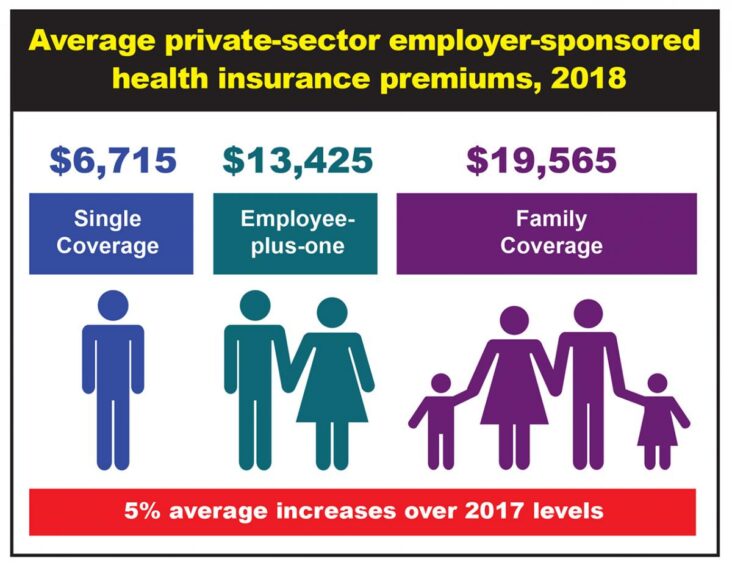

When it comes to figuring out how much you need to pay for health insurance premiums, you need to determine the deductible amount first. This can be a bit confusing and intimidating, especially if you’re new to health insurance. The key is to understand how deductibles work and to make sure you’re getting the coverage you need at a price you can afford. Knowing the basics of deductibles can help you make an informed decision when selecting a policy. Deductibles are the amount of money you must pay before your health insurance kicks in. Generally, the higher the deductible, the lower your monthly premium payment. It’s important to understand that deductibles are set annually, so you’ll need to pay the same deductible each year until the policy renews. This means that if you have a high deductible, you’ll need to pay more up front. However, if you have a low deductible, your monthly premium payment will be lower. When selecting a policy, you should also be aware of out-of-pocket maximums. This is the maximum amount you’re required to pay each year before your insurance covers all remaining costs. Knowing these basics will help you make an informed decision when choosing a health insurance policy.

What Are the Tax Advantages of Deducting Health Insurance Premiums?

If you’re looking to save some money on your taxes, you may want to consider deducting your health insurance premiums. Deducting your health insurance premiums can provide a number of tax advantages, such as reducing your taxable income and allowing you to pay less in taxes. Additionally, if you’re self-employed, you may be able to deduct up to 100% of your health insurance premiums. This means that you could potentially save even more money on your taxes. Deducting your health insurance premiums can be a great way to reduce your tax burden without having to make any major changes to your lifestyle.