Having health insurance can be a crucial safeguard against potentially unforeseen medical costs, but did you know that in some cases, you can even get health insurance retroactively? Yes, it’s true! We’ll explore in this article why and when you can get health insurance retroactive, as well as what you need to know to make sure you’re covered. Keep reading to learn more about retroactive health insurance and how it can help you protect your financial health.

What is Retroactive Health Insurance Coverage and How Does it Work?

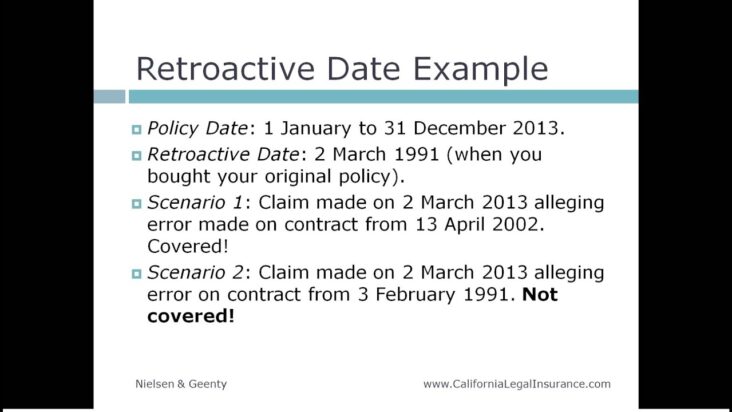

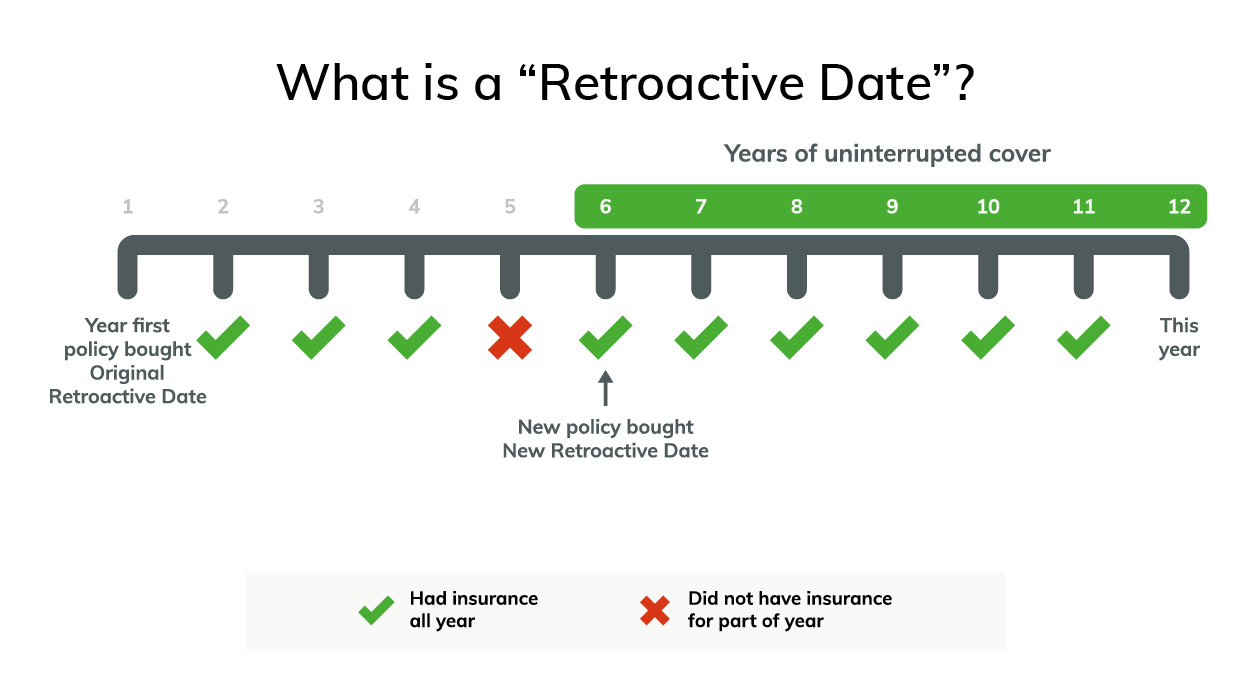

Retroactive health insurance coverage is a great way to get the coverage you need without having to worry about any gaps in your plan. In essence, it means that if you sign up for a health insurance plan after you have already incurred medical expenses, your insurance company will cover those expenses as if you had been enrolled all along. This is especially helpful if you’ve had a change of circumstances that necessitated a sudden change in coverage, like a new job. It also allows you to get coverage for pre-existing conditions that may not have been covered by your previous policy. The key is to make sure that you understand how your plan works and what exactly is and isn’t covered before signing up. That way, you can rest assured that you’re getting the coverage that you need.

The Benefits of Retroactive Health Insurance Coverage

Retroactive health insurance coverage is a great way to stay protected and have access to the medical care you need. It can be beneficial to have coverage that starts before you even realize you need it. It gives you peace of mind knowing that you are covered no matter when something happens to you. You can have your medical bills paid before you even realize you have them and can avoid any surprise medical expenses. Retroactive health insurance coverage can also secure your financial future and help you protect your savings in the event of a medical emergency. It will also give you access to the best medical care available and prevent you from having to make any difficult decisions about your health care options. With retroactive health insurance coverage, you can rest easy knowing you are covered no matter what happens.

How to Get Retroactive Health Insurance Coverage

If you’re looking to get retroactive health insurance coverage, you’ve come to the right place. While it may seem like a daunting task, getting retroactive health insurance coverage is actually quite simple. All you need to do is find a reputable health insurance provider that offers this service and fill out the necessary paperwork. It’s important to note that retroactive coverage usually only applies to plans that you’ve had in the past, so make sure to check the details before signing up. Once you’ve taken the necessary steps, you’ll be covered in the event of an illness or injury that occurred before the coverage was put in place. With retroactive health insurance coverage, you’ll be able to rest assured knowing that you’ll be taken care of no matter when you need it.

The Risks of Retroactive Health Insurance Coverage

Retroactive health insurance coverage can be a risky move and it is important to know the potential drawbacks before you decide to make the switch. Despite the fact that retroactive health insurance can be beneficial in some situations, there are a few key risks to consider. One of the biggest risks is that you may not be able to get coverage for any care that you have already received, which can be a huge financial burden. Additionally, you may have to pay higher premiums due to pre-existing conditions that you may have had prior to getting the new policy. Finally, you may end up with a plan that does not cover all of the services that you need, which can leave you with large out-of-pocket expenses. All of these risks should be considered before signing up for a retroactive health insurance plan.

Making the Most of Retroactive Health Insurance Coverage

Making the most of retroactive health insurance coverage can be a great way to ensure that you’re getting the most out of your coverage. The great thing about retroactive health insurance coverage is that it can help you avoid any gaps in your coverage and can help you save money. Retroactive coverage can also help to cover medical expenses that are incurred prior to the effective date of your coverage. This coverage can be a great way to help you pay for doctor visits, prescriptions, and other medical expenses that you may have incurred before the effective date of your coverage. If you’re looking for ways to save money on your health insurance expenses, retroactive coverage can be a great solution. Be sure to check with your provider to see what retroactive coverage options are available to you.