Medical insurance is an essential part of life in the modern age. With rising healthcare costs, having the right coverage can help keep you and your family healthy, safe, and financially secure. In this article, you’ll learn everything you need to know about medical insurance, from the basics of coverage to the best options for you and your family. We’ll explain the different types of plans and coverage, what to look for in a medical insurance policy, and how to make sure you have the best coverage for your needs. With the right knowledge and planning, you can ensure that you and your family stay safe and protected.

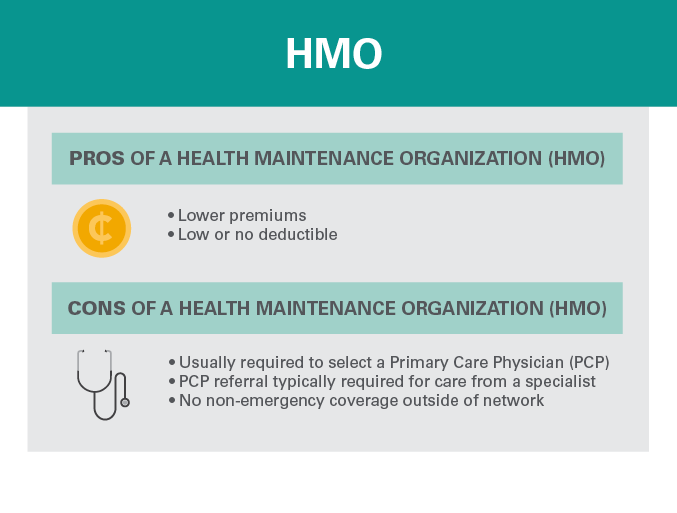

Health Maintenance Organization (HMO)

Health Maintenance Organizations (HMOs) are a form of medical insurance that offers comprehensive coverage for a variety of medical services, ranging from primary care to specialty care. HMOs provide care through a network of doctors, hospitals, and other healthcare providers, allowing members to receive quality care at an affordable price. With an HMO, you’ll typically pay a flat monthly premium, and then you’ll get access to a variety of health care services, including preventive care, emergency care, and hospitalization. Plus, with an HMO you don’t need to worry about filing claims or dealing with paperwork. You just get the care you need and pay the premium. HMOs are a great option for those who want reliable coverage at an affordable price.

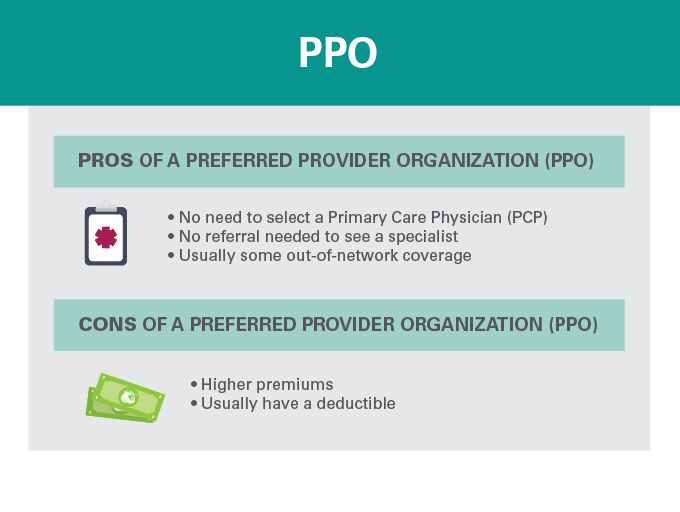

Preferred Provider Organization (PPO)

A Preferred Provider Organization (PPO) is a type of health insurance that allows you to choose from a list of approved doctors and hospitals for your medical care. With a PPO, you can go outside the network for care, but you’ll pay more out of pocket. It’s a great option if you want more flexibility when it comes to choosing your care. With a PPO, you don’t need referrals to see specialists and you don’t have to worry about paperwork. Plus, you get access to a wider network of health care providers. So, if you’re looking for a plan that gives you more control over your health care, a PPO is the way to go.

Point-of-Service Plan (POS)

A Point-of-Service plan (POS) could be a great fit for those looking for a way to get the best of both worlds when it comes to health care coverage. With a POS, you’ll have the flexibility of choosing between in-network and out-of-network providers. On top of that, you’ll have access to a primary care physician who can help coordinate your care and make sure that you’re getting the most out of your coverage. Plus, if you’re looking to keep costs down, you can take advantage of the lower co-pays and deductibles associated with in-network providers. In short, a POS plan is a great way to get the coverage and flexibility you need to stay healthy and save money.

High Deductible Health Plan (HDHP)

If you’re looking for a way to cut costs on medical insurance, then you might want to consider signing up for a High Deductible Health Plan (HDHP). These plans allow you to pay lower monthly premiums, but require you to pay a higher deductible before your insurance coverage kicks in. HDHPs are great for people who don’t expect to have many medical expenses, since the higher deductible means you’ll have to pay more out-of-pocket for medical services. But if you’re healthy and don’t anticipate needing to go to the doctor very often, then an HDHP could be a great way to save some money. Plus, you can always put the money you’re saving into a Health Savings Account (HSA), which offers tax advantages and allows you to set aside funds to cover future medical expenses. So if you’re looking for a way to save on medical insurance, an HDHP could be a great option.

Health Savings Account (HSA)

If you’re looking for a great way to save money on medical expenses, then you should definitely consider opening a Health Savings Account (HSA). An HSA is a tax-advantaged savings account that lets you set aside pre-tax dollars to cover medical expenses. It’s a great way to save money on medical costs, since the money you put into your HSA can be used to pay for things like prescription drugs, doctor visits, and even long-term care. Plus, the money you contribute to your HSA is tax-free, meaning you don’t have to worry about paying taxes on it. So if you’re looking for an easy way to save on medical costs, an HSA is definitely worth considering.